|

|

||||||

|

|

December 7, 2009 Credit Crises Generally Require Multi-Year Adjustments I want to begin with a few clarifications from last week. The first relates to my comments about what I called the "reckless myopia" of investors. Having underestimated the extent to which investors would respond to a predictable March-November 2009 lull in mortgage resets, credit losses, and economic difficulties by driving stocks back to overvaluation, a few observers quoted me last week as saying "I was wrong, because investors are stupid." That interpretation was funny, but not quite correct. Don't misunderstand - there are millions of decent, wise, prudent investors, and no shortage of talented, insightful analysts. They just evidently aren't sufficient to prevent recurrent bubbles and their subsequent failure. In the movie Men In Black, Tommy Lee Jones says to Will Smith, "A person is smart. People are dumb, panicky, dangerous animals, and you know it." Having observed the incomprehensible valuations of the late 1990's, the dot-com bubble, the housing bubble, the commodities bubble, and the private-equity bubble, all aided and abetted by investment professionals that by any standard of fiduciary duty or intellect should have known better; having observed the extent to which investors have celebrated the unethical commitment of trillions of dollars in public funds to make bank bondholders whole - the observation that investors as a herd are stupid stands wholly on its own. It's the second part of Tommy Lee Jones' remark - "and you know it" - that I regret, because remembering that is my responsibility. I did know it. One can hardly look at the past decade of financial recklessness without knowing it. But quite frankly, I didn't want to believe it (and somehow still don't want to). As a long-term investor and risk-manager, I have no such regrets. We've strongly outperformed the S&P 500 over full cycles, with much smaller periodic losses, and our stock selection has also clearly outpaced our benchmarks over time. Still, I have repeatedly been a less adept speculator than I might have been because too often, I've incorrectly given Wall Street credit for foresight. The fact that the bubbles I have avoided were in fact wiped away by spectacular declines doesn't mean that I could not have captured a larger portion of those ultimately failed advances, especially in the intermediate ranges. Over the past decade, the stature of the market as an effective discounting mechanism has gradually eroded. The observation and analysis of potential risks - though essential to long-term investing and loss avoidance - is far less actionable than one might expect. Investors will evidently speculate as long they have dice in their hands and the casino is not visibly on fire. In hindsight, less concern about the eventuality of a second wave of credit losses (which I still fully expect), might have allowed us to capture a larger portion of the recent advance, at least moving our year-to-date returns into two digits. This is something of a personal struggle, because I see my main fiduciary duty as focusing on long-term performance and avoiding major losses where possible. Short-term speculative participation is often what gets sacrificed, but that can be very uncomfortable - especially over the short-term. Quantitative models are much less helpful than one might think, because during unusual speculative runs, one can often identify obvious, specific, objective risks (e.g. free entry and lack of competitive barriers for dot-com stocks in the late-1990s, a heavy Alt-A and Option-ARM reset schedule today) that purely historical models may be ill-suited to capture. Expanding the historical data set has its own challenges (as I've noted in the "two data sets" discussion of recent months). Again, however, there is undoubtedly some middle ground that we can exploit while still keeping a tight rein on significant risks. I have to keep reminding myself that Wall Street, as a rule, doesn't seem to share all of our fiduciary concerns. I noted last week that from a Bayesian perspective, I would estimate a probability of nearly 80% that we will observe a second round of credit losses coupled with a market plunge in the coming year or so. That doesn't imply an all-out "crash," but more likely a retreat similar in size to what we have often observed following other post-crash rebounds (about -28% on average). Of course, from the standpoint of compounding, a 28% decline converts a 60% gain to a more modest 15% net advance, so even without an outright "crash," it would not be surprising to see the majority of the gains since the March low wiped out. Most likely, we may see a few more years of sideways movement after that, as the economy absorbs the full weight of adjustment to the deleveraging of bad debt and massive increase in government liabilities that we have on our hands. Suffice it to say that I do not anticipate a V-shaped recovery, and while the stock market may very well recover faster than the rest of the economy, I don't expect durable market gains until after the second wave of losses shakes out. On the subject of credit delinquencies, the latest report by Trepp (which provides independent research on commercial mortgage-backed securities) indicates that delinquencies on multifamily CMBS loans rose to 8.78 percent in November, up from 7.66 percent the previous month. Commercial delinquencies in retail, industrial and office loans increased as well. The largest jump in delinquencies was in the hotel sector, where the delinquency rate shot to 14.09 percent, from 8.67 percent in October. The data from the banking sector also shows no abatement.

A pleasant employment number Notwithstanding my expectation that the adjustment from the recent (and I expect ongoing) credit crisis will be a multi-year process, we did observe a nice employment figure in the November jobs report. Last month's relatively benign job loss figure of -11,000 was somewhat surprising, but not the shock that some analysts suggested. With the 4-week average of new claims for unemployment currently running at 481,250, a monthly payroll loss of slightly over 100,000 jobs would have been more consistent, but there's a lot of month-to-month noise in those figures. Meanwhile, 98,000 workers dropped out of the labor force last month, so the unemployment rate ticked down slightly despite the net loss in jobs. Essentially, the -11,000 job loss reported last month would have been expected from a 4-week average jobless claims figure closer to 400,000. A sustained move to fewer than 400,000 new unemployment claims over more than 4 weeks or so is probably where we would expect to observe predictable job growth, though given the noise in the data series, it's certainly possible to observe a positive monthly jobs figure without that. In light of my expectations for a second round of credit difficulties, I should note that in the interim between the 1980 and 1981-82 recessions we did observe positive job growth, so while the recent direction in the job market is encouraging, we should be careful not to infer much in the way of guaranteed sustainability from these improvements.

Credit crises generally require multi-year adjustments "During the first year following the crisis (2007), exactly the opposite happened: the dollar appreciated and interest rates fell as world investors viewed other countries as even riskier than the United States and bought Treasury securities copiously. But buyer beware - over the longer run, the U.S. exchange rate and interest rates could well revert to form, especially if policies are not made to re-establish a firm base for long-term fiscal sustainability. "Broadly speaking, financial crises are protracted affairs. More often than not, the aftermath of financial crises share three characteristics: First, asset market collapses are deep and prolonged. Declines in real housing prices average 35 percent stretched out over six years, whereas equity price collapses average 56 percent over a downturn of about three and a half years. Reports of nonperforming loans are often wildly inaccurate, for banks try to hide their problems as long as possible and supervisory agencies often look the other way. "Second, the aftermath of banking crises is associated with profound declines in output and employment. Output falls (from peak to trough) more than 9 percent on average, although the duration of the downturn, averaging roughly two years, is considerably shorter than that of unemployment [at its recent trough in the second-quarter of 2009, U.S. real GDP had declined by approximately 4 percent from its peak four quarters earlier]. "Third, the value of government debt tends to explode. The main cause of debt explosions is not the widely cited costs of bailing out and recapitalizing the banking system. Admittedly, bailout costs are difficult to measure, and the divergence among estimates from competing studies is considerable. But even upper-bound estimates pale next to actual measured increases in public debt. In fact, the biggest driver of debt increases is the inevitable collapse in tax revenues that governments suffer in the wake of deep and prolonged output contractions. "Yet, in many ways, this 'Second Great Contraction' is a far deeper crisis than others in the comparison set, because it is global in scope, whereas other severe post-World War II crises were either country-specific or at worst regional." Economists Kenneth Rogoff (Harvard University) & Carmen Reinhart (Univ. of Maryland) I should note that Reinhart and Rogoff were among the few academic economists who clearly anticipated the recent credit crisis, even publishing a working paper (13761) through the National Bureau of Economic Research in January 2008 articulating these risks. The September 28 weekly comment featured some of this work. Aside from the likelihood of further credit losses, my primary macroeconomic concern at present is the likelihood of far larger deficits and eventually, inflation, than investors appear to anticipate. As I've noted before, the inflation issue is most likely several years out, because over the shorter run, fresh credit difficulties are likely to boost "safe haven" demand for default-free U.S. government liabilities, which will allow the huge new float of these liabilities to be absorbed without an immediate deterioration in their value. From a longer-term perspective, particularly after we work through the adjustments of the next two or three years, it appears very unlikely that the enormous collapse in "monetary velocity" that we've seen during this crisis will be sustained. Over time, the increased supply of U.S. government liabilities (whether in the form of monetary base or Treasury securities) is likely to be met by a similar depreciation in their value. I continue to expect that we will observe an approximate doubling of the U.S. consumer price index over the next decade. Reviewing some recent comments from Rogoff (who used to be head of the International Monetary Fund) and Reinhart, it's notable that they share these same concerns: "Assuming the U.S. continues going down the tracks of past financial crises, perhaps the scariest prospect is the likely evolution of public debt, which tends to soar in the aftermath of a crisis. A base-line forecast, using the benchmark of recent past crises, suggests that U.S. national debt will rise by $8.5 trillion over the next three years. Debt rises for a variety of reasons, including bailout costs and fiscal stimulus. But the No. 1 factor is the collapse in tax revenues that inevitably accompanies a deep recession. Financial crises don't last forever. But this one could last a lot longer if policymakers don't start basing their actions on more realistic assessments of where we are and what is likely still to come." "The marketplace is suggesting that there's not going to be a lot of inflation in the near term. During the height of the crisis the alternatives to dollar assets were not there. It wasn't irrational, but it was lack of alternatives. What concerns me most about inflation is not something that is imminent. The inflation question becomes more pressing in a 5-10 year time horizon—and it's not 5 years from now, it's 5 years from where the crisis started, which was two years ago. If we had a history of defaults, like in South America, that horizon would be compressed. For other cases, you have more time." To underscore the concerns here, I've presented a few charts below on our current fiscal and monetary situation: Federal tax revenues are still likely to suffer their steepest drop since the Depression

State tax revenues are projected to recover much more slowly than after past downturns.

Total public debt has already soared by 30% since the beginning of the recession, and with unemployment high and initial GDP growth far more tepid than past recoveries (which typically see 6%+ GDP growth out of the gate), is likely to expand further.

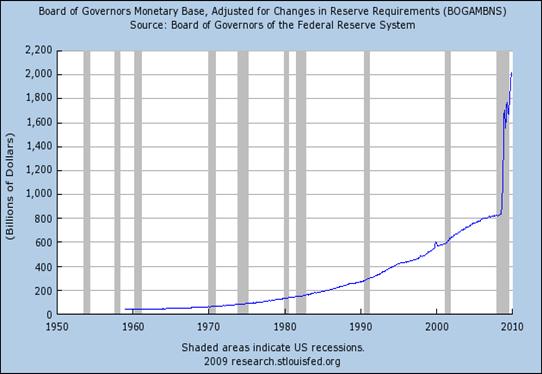

Finally, the Federal Reserve has expanded the U.S. monetary base by more than 150% since the beginning of the recession. That is not a typo. The monetary base has soared from $800 billion to over $2 trillion. Much of this has been accomplished through outright purchases of mortgage-backed securities (not repurchases) and an equivalent creation of base money. Unless these securities can be sold back out into private hands for the same value that was paid to acquire them, the Fed will have effectively forced the U.S. government to make its implicit guarantee of these agency securities explicit, without the authorization of Congress. To the extent that the underlying mortgages default, the U.S. government will be forced to issue additional Treasuries to retire the mortgage backed securities now held by the Fed. Alternatively, if the U.S. does not explicitly bail out Fannie Mae and Freddie Mac to the full extent, the Fed will have created money, with no recourse, and without the equivalent backing of assets or securities on its books. In short, the Fed is now engaging in unlegislated, back-door fiscal policy.

To end with a recent quote from Carmen Reinhart, "In America, the Fed has injected a lot of money into the economy as a response to the crisis. Right now the Fed has about a trillion dollars of Fannie and Freddie on their balance sheet, and that's not going to turn out very well, and it hasn't been recognized." Market Climate As of last week, the Market Climate for stocks was characterized by unfavorable valuations and mixed market action. On the valuation front, the S&P 500 is currently priced to deliver an average total return over the next decade of about 6% annually - one of the lowest figures on record except for the late 1920's, the richest valuations of the 1960's (which were followed by about 17 years of flat returns) and the overvalued and ultimately unrewarding period since the late 1990's. Importantly, that calculation does not assume any long-term impact of the recent credit crisis, but is instead based on the maintenance of the long-term peak-to-peak growth channel that has characterized S&P 500 earnings for most of the past century. The stock market is not cheap by any means, except in comparison to strenuously overvalued and ultimately unrewarding valuations of the past. This fact is coupled with investment advisory bearishness of only 16.3%, strenuous overbought conditions on an intermediate-term basis, and emerging non-confirmations (including for example, breadth as measured by advances versus declines, which remains below the peaks of a few months ago, as do several volume-based measures). That said, there is also a large contingent of investment advisors in the "correction" camp. That suggests that we may observe a somewhat more extended tendency toward shallow selloffs followed by sharp rebounds, as investors looking for a correction look to "buy the dips." Though that may be reasonable behavior here, my impression is that trading such dips in anticipation of sustained market gains relies too much on the maintenance and extension of already stretched valuations. For our part, we continue to maintain a small positive exposure to market fluctuations, adding modestly on market weakness and clipping it on strength, with overall exposures generally below 15%, and at least out-of-the-money put-option defense on nearly all of our stock holdings. Even this modest amount of exposure will shift to zero if we observe any meaningful deterioration in market internals. In bonds, the Market Climate last week was characterized by modestly unfavorable yield levels and neutral yield pressures. On Thursday, we exited nearly all of our remaining precious metals positions for the Strategic Total Return Fund. On Friday, precious metals and foreign currencies experienced violent weakness on the employment number, and we moved back to a roughly 2% exposure in both precious metals shares and foreign currencies. While I do expect that the next decade will feature much more difficult inflation consequences than are widely assumed, the near term pressures are likely to be temporarily downward if we observe fresh credit concerns. So while we've responded to the sharp price drops on Friday with some modest exposure, larger and longer-term investment positions are likely to await further weakness in gold and foreign currencies, coupled with a bout of U.S. dollar strength, in the face of second-wave credit difficulties and a flight to default-free U.S. Treasuries. Meanwhile, as usual, we will continue to expand these positions modestly in response to weakness, and clip them on strength, as is our discipline. --- The foregoing comments represent the general investment analysis and economic views of the Advisor, and are provided solely for the purpose of information, instruction and discourse. Prospectuses for the Hussman Strategic Growth Fund, the Hussman Strategic Total Return Fund, the Hussman Strategic International Fund, and the Hussman Strategic Dividend Value Fund, as well as Fund reports and other information, are available by clicking "The Funds" menu button from any page of this website. |

|||||||||||||||||||||||||

|

For more information about investing in the Hussman Funds, please call us at

1-800-HUSSMAN (1-800-487-7626) 513-326-3551 outside the United States Site and site contents © copyright Hussman Funds. Brief quotations including attribution and a direct link to this site (www.hussmanfunds.com) are authorized. All other rights reserved and actively enforced. Extensive or unattributed reproduction of text or research findings are violations of copyright law. Site design by 1WebsiteDesigners. |