An Abrupt and Cascading Dislocation

John P. Hussman, Ph.D.

President, Hussman Investment Trust

Special Interim Comment: April 16, 2025

Brief Observations

The Market Climate remains on a Crash Warning. We have to allow for the possibility of the usual fast, furious bear market rallies that can occur after the market becomes oversold. Overall, our position remains defensive, but we’re managing our positions in a way that accommodates a bounce. It’s unfortunate, in my view, that investors have so much faith that a monetary easing can and will bail out the economy and the stock market. My view is fairly simple – the economic boom we’ve enjoyed has been driven by an inordinate amount of leverage, much of it of very poor credit quality, and by capital spending financed through the import of foreign savings. In an environment where demand for new capital investment was strong, easy bank credit and ample foreign savings fed extremely good economic growth rates. But I believe we are past that point here.”

– John P. Hussman, Ph.D., Market Comment, December 19, 2000

It can be dangerous to attempt trading bear market rallies early into a decline – especially when valuations remain rich. It’s useful to remember that the 1929 and 1987 crashes started after the S&P 500 was already down about 14% from its highs. So emerging panic is not enough – there has to be some basis to believe that a positive shift in investor attitudes toward risk would be sustainable. What we do observe, however, is that prices are somewhat oversold on a very short-term basis, so it’s reasonable to allow for one of those fast, furious bounces to clear that condition… investors should not immediately abandon caution when they emerge.”

– John P. Hussman, Market Comment, June 23, 2008

Remember that the first line down following a market peak is typically vertical. The steep initial losses typically make investors feel like fools to sell into the decline, and the clearing rallies that follow convince them that everything is still fine. That process, in repeated sequence, is why investors tend to hold on the whole way down, often eventually capitulating at the lows.”

– John P. Hussman, Ph.D., You’re Soaking In It, July 21, 2024

I’ve regularly described the period since early 2022 as the extended peak of the third great speculative bubble in U.S. history. As I noted in the April comment, Humpty Dumpty was Pushed, I believe that process is now complete. As discussed in that comment, our Recession Warning Composite also now indicates the likelihood of an oncoming recession in the U.S. economy.

In our day-to-day investment discipline, we’ve had several opportunities to vary the intensity of our defensive investment stance, some informed by the hedging implementation I described last September (for more, see Asking a Better Question, Subsets and Sensibility, and the section titled “The Martian” in The Turtle and the Pendulum), and some in response very short-lived “compression syndromes” that I’ve regularly discussed over the years.

While we remain open to changes in market conditions, as well as periodic “fast, furious, prone-to-failure” advances that can relieve the oversold “compression” produced by market losses, we are presently on high alert for a possibly abrupt and cascading market and economic dislocation in the weeks ahead.

The trap door swings open

At its core, a market crash is nothing but risk-aversion meeting a market that’s not priced to tolerate risk. We always become concerned about “trap door” outcomes when rich valuations are joined by deterioration in the uniformity of market internals – which is our most reliable gauge of speculation versus risk-aversion among investors.

Our concerns about trap door conditions become even more pointed when investor confidence has been destabilized. Recall that the 1929 and 1987 crashes started after the S&P 500 was already down about 14% from its highs. As a general rule-of-thumb, when investors are jolted by a decline in the S&P 500 of 10% or more from its 10-week high, and Baa corporate yields or credit spreads are widening, “trap door” conditions tend to be resolved by abrupt and often substantial market losses.

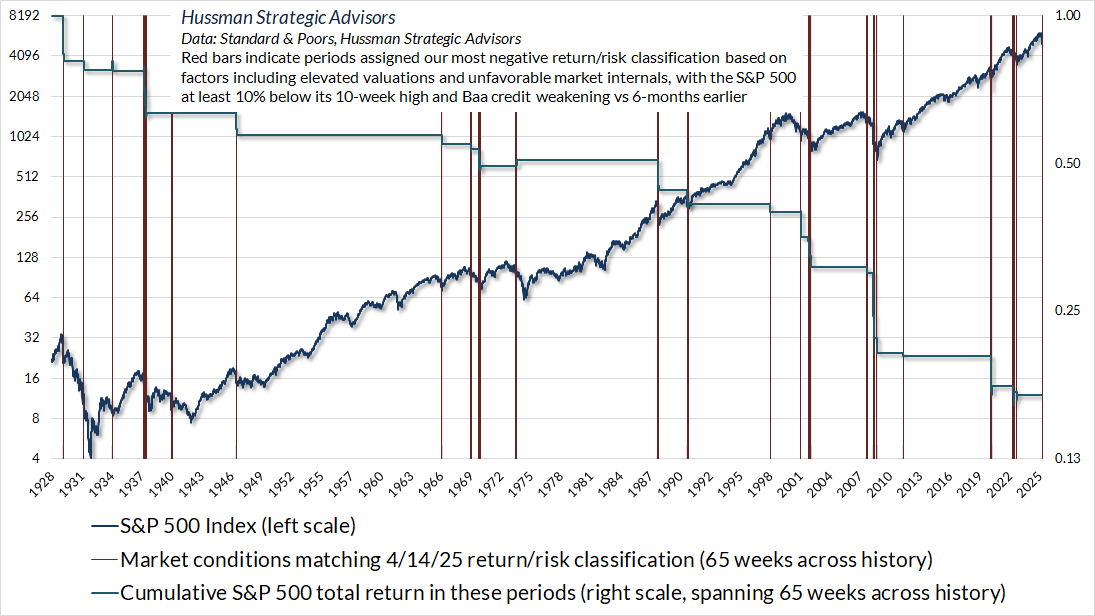

The chart below shows what this looks like, in data since 1928. The blue line is the S&P 500 Index (left scale, log). The red bars show instances that are assigned our most negative return/risk classification – based on measurable, observable market conditions such as valuations and market internals – coupled with a loss in the S&P 500 of more than 10% from its 10-week high and deteriorating Baa credit conditions (versus 6 months prior). The green line (right scale, log) is the cumulative return of the S&P 500 in the 65 weeks since 1928 when this particular set of conditions has been in effect. It’s a rare syndrome, but it has regularly occurred at the breakpoint of memorable market collapses, including 1929, 1987, 2000, 2008, and 2020.

Notice that the green line looks as if it’s almost a stairstep. That’s because steep losses are so common once the trap door swings open. I’ve periodically described this sort of environment as a “crash warning.” Emphatically, that term is not intended as a forecast, but simply as a shorthand for market conditions that are often followed by abrupt mismatch of desired selling versus desired buying, and are typically resolved with price declines large enough to bring the two into equilibrium.

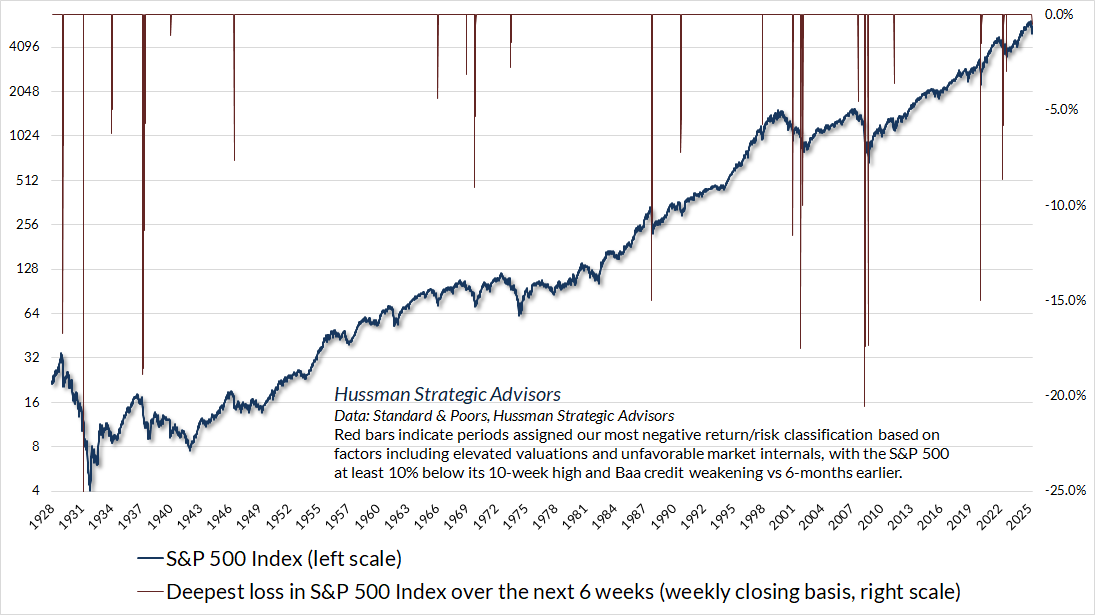

The chart below shows the largest loss in the S&P 500 – on a weekly closing basis – in the 6-week period following each of the instances above. Perhaps needless to say, the losses on a daily closing basis are worse.

One way to understand abrupt market losses is to consider what I’ve often called the “Iron Law of Equilibrium.” Every share of stock that’s been issued must be held by some investor at every point in time. Investors cannot “get out” of stocks, in aggregate, nor can they “get into” stocks, in aggregate. Every dollar a buyer brings “into” the market is taken “out of” the market by a seller. Every dollar a seller wishes to take “out of” the market has to come “into” the market from a buyer.

Consider, for simplicity, two sets of market participants – “trend-following” investors whose demand reflects backward looking market returns, and “value-conscious” investors whose demand reflects the level of market valuations and, by extension, expected future returns.

As I’ve shown in simulations of this kind of equilibrium, when prices are unusually elevated relative to the norm, it’s almost always because trend-followers (and other price-insensitive buyers) are “all in.” Those positions are – and in fact have to be – offset by equal and opposite underweights by value-conscious investors. A sudden decrease in the desired holdings of trend-followers and price-insensitive traders has to be satisfied by inducing a price decline large enough to give value-conscious investors an incentive to buy.

At its core, a market crash is nothing but risk-aversion meeting a market that’s not priced to tolerate risk. We always become concerned about “trap door” outcomes when rich valuations are joined by deterioration in the uniformity of market internals – which is our most reliable gauge of speculation versus risk-aversion among investors. Our concerns about trap door conditions become even more pointed when investor confidence has been destabilized. We are presently on high alert for a possibly abrupt and cascading market and economic dislocation in the weeks ahead.

As always, nothing in our investment discipline relies on forecasts, particularly involving extreme outcomes like those above. Instead, our discipline is to align our investment outlook with prevailing, measurable, observable market conditions, and to change our outlook as those conditions change. Even amid the initial break of what we view as the third great speculative bubble in U.S. history, we’ve had multiple opportunities to vary the intensity of our defensive outlook in response to market behavior, and we continue to watch for “compression syndromes” that can produce “fast, furious, prone-to-failure” market advances to clear oversold conditions.

For now, I would describe present market conditions as a “crash warning” – featuring an environment that includes extreme valuations, broken market internals, and destabilized investor confidence. Nothing in these conditions ensures a market collapse – abrupt crashes are the rarest of events, and investors should approach current risks with that understanding. Still, we should be aware that virtually all market crashes share a common feature – risk-aversion meeting a market that’s not priced to tolerate risk.

A final risk

Because silence can be equal to consent, I’ll add that these unfavorable market conditions are joined by other observable elements that are deeply troubling in my view: the rapid descent of the U.S. toward an autocracy that normalizes the unchecked abuse of power; dispenses with the rule of law, due process, and human rights; dismantles democratic institutions; replaces career civil servants with loyalists; systematically defunds public health research and disease surveillance; retaliates against critics; raises barriers to access of Social Security offices and earned benefits; pressures law firms not to represent clients; exploits every opportunity for self-dealing; defunds universities, purges libraries, and whitewashes museums of so-called “improper ideology”; maligns journalists and bars access to news organizations that resist absurd demands; abandons, betrays, and disparages allies; openly seeks to annex sovereign countries; floods public dialogue with disinformation, grievance, fear, division, and false narratives; expels independent Inspectors General along with the capacity of the public to demand accountability; and deliberately erodes constitutional constraints in favor of personal dictate.

Perhaps the escalating risk of a market crash and cascading economic dislocation isn’t surprising after all.

We’re more than this. More than our division. More than the blame we cast on the other “side.” All of us are made of this shared substance of common humanity. The tragedy is that in our anger, we can’t see it – only us versus them. As my beloved friend and teacher Thich Nhat Hanh often said, “Enlightenment is the moment a wave recognizes that it is the water.”

Our enemy isn’t each other – even the people we blame for all of our own suffering since the time we were 5 years old have suffered themselves since the time they were 5 years old. The blame falls to hatred, injustice, and ignorance themselves; the greed, violence, abuse, and lack of compassion that come from our illusion that “we” and “them” are separate; the failure to even consider how the other side has suffered – something both liberals and conservatives share; and worst, the destructive impulse to eliminate everything – even human beings – that we associate with the other “side.” All of us risk falling into that trap, and we can see our way out. If we have the insight to see that the other person also suffers, we know better what to do, and what not to do, to go forward.

Look, I’ll speak out and fight against hatred, division, avarice, corruption, and injustice all day long. But it’s those elements, not human beings, that are the enemy. I hope others do the same, but also always considering the suffering of the other “side.” Even those who fight for the dignity and equality of others – especially those who are different – have to be mindful enough to see the moment when others feel threatened that those differences will overwhelm their way of life. When any side goes unheard for too long, their response is often to destroy, even without considering the consequences. My concern is that it’s happening within our government and nation right now.

This is, because that is

This is not, because that is not

They are like this, because we are like that

They are not like this, because we are not like that– Buddha

Despite our differences, and a thousand failures to become “a more perfect union,” we still have the capacity to listen to each other and work together to solve problems. We still have the chance to preserve a United States of America that dignifies the patriots who sacrificed their lives for this precious democracy – this Constitutionally based republic – without dispensing with “democracy,” or “Constitution”, or “United.” In our anger and division, we are further along the path of losing that precious inheritance than we may want to admit.

Keep Me Informed

Please enter your email address to be notified of new content, including market commentary and special updates.

Thank you for your interest in the Hussman Funds.

100% Spam-free. No list sharing. No solicitations. Opt-out anytime with one click.

By submitting this form, you consent to receive news and commentary, at no cost, from Hussman Strategic Advisors, News & Commentary, Cincinnati OH, 45246. https://www.hussmanfunds.com. You can revoke your consent to receive emails at any time by clicking the unsubscribe link at the bottom of every email. Emails are serviced by Constant Contact.

The foregoing comments represent the general investment analysis and economic views of the Advisor, and are provided solely for the purpose of information, instruction and discourse.

Prospectuses for the Hussman Strategic Market Cycle Fund, the Hussman Strategic Total Return Fund, and the Hussman Strategic Allocation Fund, as well as Fund reports and other information, are available by clicking Prospectus & Reports under “The Funds” menu button on any page of this website.

The S&P 500 Index is a commonly recognized, capitalization-weighted index of 500 widely-held equity securities, designed to measure broad U.S. equity performance. The Bloomberg U.S. Aggregate Bond Index is made up of the Bloomberg U.S. Government/Corporate Bond Index, Mortgage-Backed Securities Index, and Asset-Backed Securities Index, including securities that are of investment grade quality or better, have at least one year to maturity, and have an outstanding par value of at least $100 million. The Bloomberg US EQ:FI 60:40 Index is designed to measure cross-asset market performance in the U.S. The index rebalances monthly to 60% equities and 40% fixed income. The equity and fixed income allocation is represented by Bloomberg U.S. Large Cap Index and Bloomberg U.S. Aggregate Index. You cannot invest directly in an index.

Estimates of prospective return and risk for equities, bonds, and other financial markets are forward-looking statements based the analysis and reasonable beliefs of Hussman Strategic Advisors. They are not a guarantee of future performance, and are not indicative of the prospective returns of any of the Hussman Funds. Actual returns may differ substantially from the estimates provided. Estimates of prospective long-term returns for the S&P 500 reflect our standard valuation methodology, focusing on the relationship between current market prices and earnings, dividends and other fundamentals, adjusted for variability over the economic cycle. Further details relating to MarketCap/GVA (the ratio of nonfinancial market capitalization to gross-value added, including estimated foreign revenues) and our Margin-Adjusted P/E (MAPE) can be found in the Market Comment Archive under the Knowledge Center tab of this website. MarketCap/GVA: Hussman 05/18/15. MAPE: Hussman 05/05/14, Hussman 09/04/17.