Pushing Your Luck

John P. Hussman, Ph.D.

President, Hussman Investment Trust

January 2023

One can go some distance in a mine field without anything blowing up – it’s just that the overall odds aren’t good. For now, market action remains unfavorable, which suggests that the enthusiasm of investors is not yet robust, and further skittishness is possible. But again, there is no particularly strong reason to expect one direction over another over the very short term. In any event, conditions remain poor from a valuation standpoint. Stocks are emphatically not ‘cheap.’

It’s particularly interesting that the forward operating earnings crowd has advanced the notion that stocks are as cheap as they were in 1990. Aside from the problems with forward operating earnings that I’ve previously detailed, this particular argument rests on overlooking the state of profit margins, which were quite depressed in 1990 and are at record highs currently. Think about that for a moment and you’ll see what’s going on. A forward P/E multiple on depressed profit margin assumptions provides at least some margin for error. The same forward P/E based on assumptions of the highest profit margins in history contains no such margin.

– John P. Hussman, Ph.D., August 27, 2007, shortly before the global financial crisis

The problem with speculation is that there’s usually a gap between the underlying risk and the inevitable outcome. The gap is most dangerous when there are potential rewards for pushing your luck.

In July 2007, Chuck Prince, the CEO of Citigroup, famously pushed his luck saying “When the music stops, in terms of liquidity, things will get complicated. But as long as the music is still playing, you’ve got to get up and dance.” The deterioration that would shortly unfold into a global financial crisis was already underway. After years of Fed-induced yield-seeking speculation in mortgage securities, aided by demand from yield-starved investors, and abetted by Wall Street institutions that were all too ready to supply new “product,” the inevitable implosion would produce a 55% loss in the S&P 500, and a 98% loss in the value of Citigroup.

Unfortunately, the rewarding gap between underlying risk and inevitable outcomes can encourage people to persist in reckless behavior. In 2007, the tragic results of that behavior were already baked in the cake. Only the timing was uncertain. As I wrote at the time, one can go some distance in a mine field without anything blowing up – it’s just that the overall odds aren’t good.

The distortions in the financial markets are different today than they were in 2007. This time around, the Fed starved investors of yield for a decade, and much more aggressively. Looking in the rear-view mirror, the effects of relentless yield-seeking speculation look glorious. But the unwind may be breathtaking. The distortions in the stock market are far beyond those of 2007, more closely resembling 1929 and 2000. That remains true, even though the bubble peaked a year ago. Since then, the S&P 500 has lost a modest -15.7%, including dividends.

I continue to expect that the unwinding of this bubble will drive the S&P 500 to just one-third of the level it set at its January 2022 peak. I know – that seems preposterous. That’s why I present statements like that with data, as I did before the global financial crisis in 2007, and as I did when I projected an 83% loss in technology stocks in March 2000. Preposterous, yet also unfortunately correct.

Investors often make the mistake of dismissing rich valuations if they don’t result in immediate losses. That’s emphatically not how valuations work. Extreme valuations are not equal to a near-term forecast about market direction. Rather, our investment discipline is to align our outlook with measurable, observable market conditions – including both valuations and market internals – and to shift our investment outlook as those conditions shift. No forecasts or scenarios are required.

Before the current yield-seeking speculative bubble does unwind – 2022 was only a warmup, in my view – recall that the only thing truly “different” about quantitative easing and zero interest rate policy was that it encouraged investors to speculate beyond any well-defined historical “limit,” on the belief that zero interest rates left them with no other alternative. As I’ve detailed regularly, I ultimately abandoned our detrimental bearish response to those “limits,” and I’m pleased that the benefit of those adaptations has become increasingly clear in the past few years.

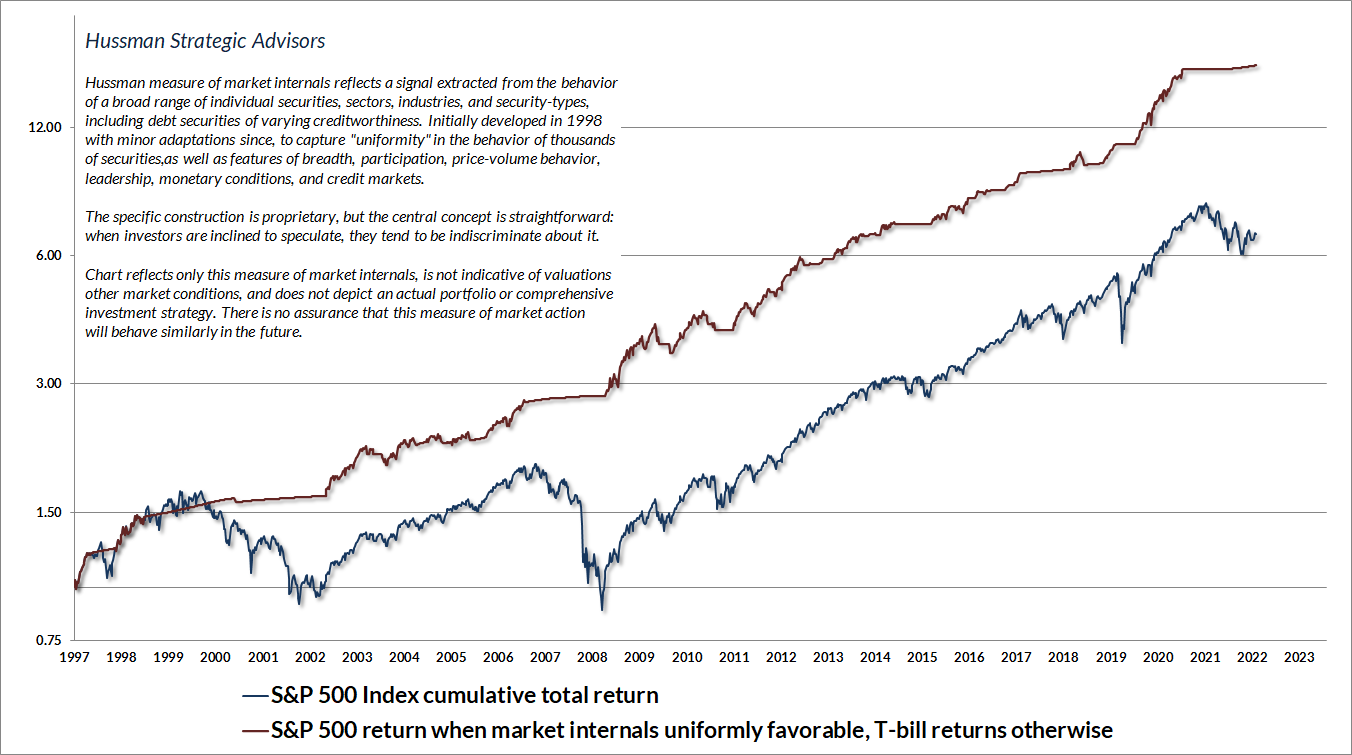

Valuations and market internals continue to be essential in navigating the complete market cycle. Our most reliable valuation measures remain well-correlated with subsequent long-term returns and full-cycle drawdowns. Indeed, while the average level of valuations has been above historical norms in recent decades, the average level of subsequent returns has predictably been lower than historical norms. It has taken the most extreme yield-seeking bubble in history to bring the total return of the S&P 500 to even 6.27% since its March 2000 peak, much of which I suspect will be wiped out in the next few years. Likewise, the entire total return of the S&P 500 in the most recent market cycle accrued in periods when market internals were favorable.

Investors often make the mistake of dismissing rich valuations if they don’t result in immediate losses. That’s emphatically not how valuations work. Extreme valuations are not equal to a near-term forecast about market direction. Rather, our investment discipline is to align our outlook with measurable, observable market conditions – including both valuations and market internals – and to shift our investment outlook as those conditions shift. No forecasts or scenarios are required.

Still, it’s impossible for us to examine current valuation extremes without also allowing for the S&P 500 to lose more than half of its value – even from here. That’s not so much a forecast as a “full cycle” estimate of the market loss that would be required to restore historically run-of-the-mill expected returns. It’s also worth noting that when Treasury bill yields have stood between 3-5%, as they do today, our most reliable valuation measures have stood at just half of their present levels, on average.

More immediate outcomes will be driven by the ebb and flow of investor psychology between speculation and risk-aversion, and we gauge that by the uniformity of market internals. Presently, both valuations and market internals remain unfavorable, which creates what I call a “trap door” situation.

Investors could certainly take the speculative bit back in their teeth, despite an overvalued market. That would be fine with us, as we’ve abandoned our belief that there is any well-defined “limit” to that willingness. Changes in Fed policy, reasonable or not, would also be fine with us, at least from the standpoint of our investment discipline. We’ll respond to conditions as they change, and take the evidence as it comes.

Two levers of the trap door

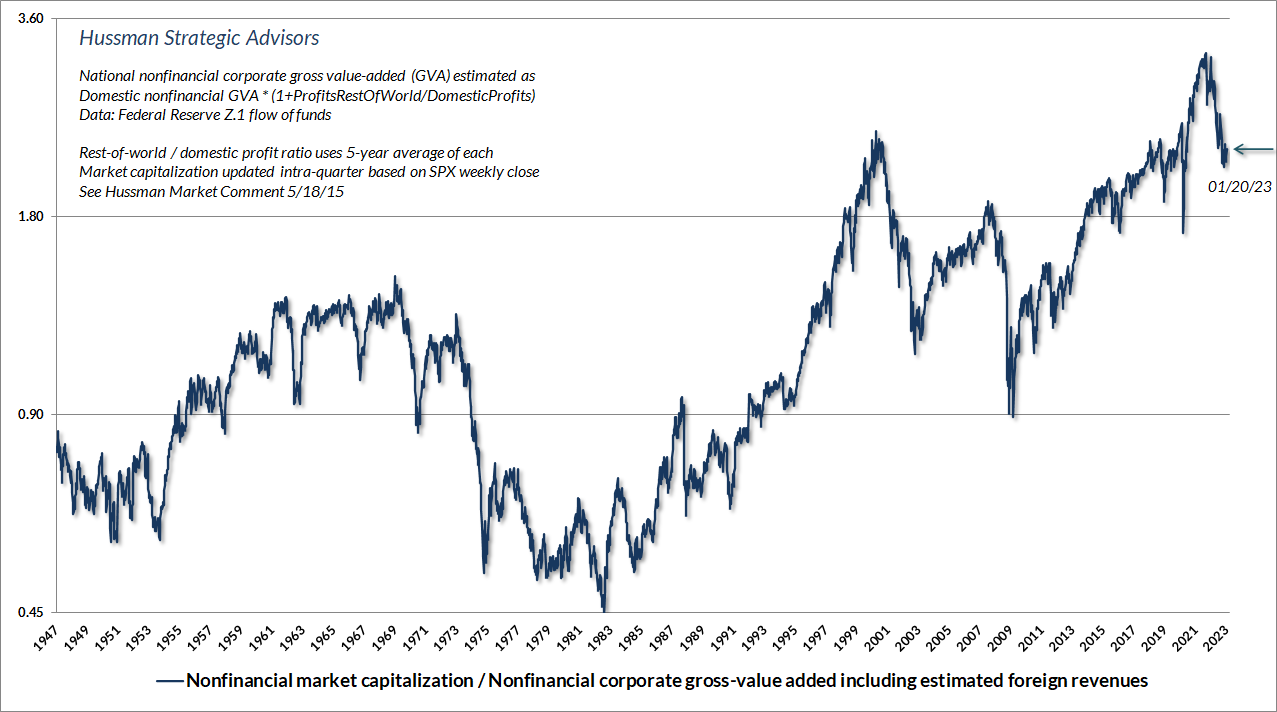

A few charts will help to illustrate our concerns about current market conditions. Below is our single most reliable valuation measure: the market capitalization of nonfinancial corporations as a ratio to gross value-added, including estimated foreign revenues. We gauge the reliability of our valuation measures based on their correlation with actual subsequent market returns across history. Other reliable measures (for example, Market Cap/GDP, S&P 500 price/revenue, and our Margin-Adjusted P/E) look quite similar. The advance to the January 2022 market peak took valuations beyond the extremes of 2000 and even 1929. Last year’s market decline merely skimmed the most speculative froth, bringing valuations to the same extreme we observed at the March 2000 bubble peak.

Emphatically, valuations don’t operate in a vacuum. It would have been impossible for valuations to reach speculative extremes like 1929, 2000, and 2022 without also continuing to advance persistently beyond lesser extremes. During the late-1990’s technology bubble, I scoured the historical data for factors that might help to distinguish an overvalued market that continues to advance from an overvalued market that drops like a rock. My answer was, and remains, investor psychology – specifically, whether investors are inclined toward speculation or risk aversion.

In 1998, I introduced our gauge of market internals – what I called “trend uniformity” at the time. It continues to be an essential element of our investment discipline. The specific signal extraction approach is one of the few things I keep proprietary, but I’m very open about the central concept. When investors are inclined to speculate, they tend to be indiscriminate about it, so the “uniformity” of market internals across thousands of stocks, industries, sectors, and security-types conveys information about that psychology.

In the face of zero interest rate policies, we had to abandon our bearish response to historically-reliable “limits” to speculation. In contrast, valuations and market internals continue to be essential to our investment discipline, and that emphasis has restored the strategic flexibility that we enjoyed across decades of complete market cycles. In my view, it would be profound mistake to take our difficulty with speculative “limits” as a reason to dismiss the “trap door” opened by the two levers of unfavorable valuations and unfavorable market internals.

The chart below presents the cumulative total return of the S&P 500 in periods where our measures of market internals have been favorable, accruing Treasury bill interest otherwise. The chart is historical, does not represent any investment portfolio, does not reflect valuations or other features of our investment approach, and is not an assurance of future outcomes. The flat portions in the chart below are periods when, like last year, market internals were persistently unfavorable, leading us to prefer T-bills or hedged equity to unhedged market risk. You’ll see the same tendency during the 2000-2002 and 2007-2009 collapses. We can’t rule out “whipsaws,” and we don’t expect internals to “catch” short-term market fluctuations. Still, in the nearly 25 years since I introduced our measure of market internals, I haven’t found a more useful way to gauge speculation versus risk-aversion.

Causes and conditions

By relentlessly depriving investors of risk-free return, the Federal Reserve has spawned an all-asset speculative bubble that we estimate will provide investors little but return-free risk.”

– John P. Hussman, Ph.D., Return-Free Risk, January 14, 2022

Over the past year, the S&P 500 has retreated only modestly from its January 2022 speculative peak, yet interest rates have normalized to a much greater extent. That, in my view, is probably the most dangerous aspect of the current market environment. We continue to observe valuations that were created only as the result of a decade of reckless zero-interest rate policy, yet zero-interest rate policy is no longer present.

As the Buddha taught, “All things appear and disappear because of the concurrence of causes and conditions. Nothing ever exists entirely alone; everything is in relation to everything else.” With interest rates now well above zero, the primary causes and conditions of the recent speculative bubble are no longer in place. The persistence of rich valuations here are, in my view, largely the result of psychological anchoring and hindsight that treats past prices as a standard of value. We saw the same thing during the 2000-2002 collapse, and it’s dangerous. I had friends who were wiped out, not by buying at the top, but by assuming that once prices had declined by 15%, or 20%, or in some cases 50% from the highs, the retreat somehow represented “value.”

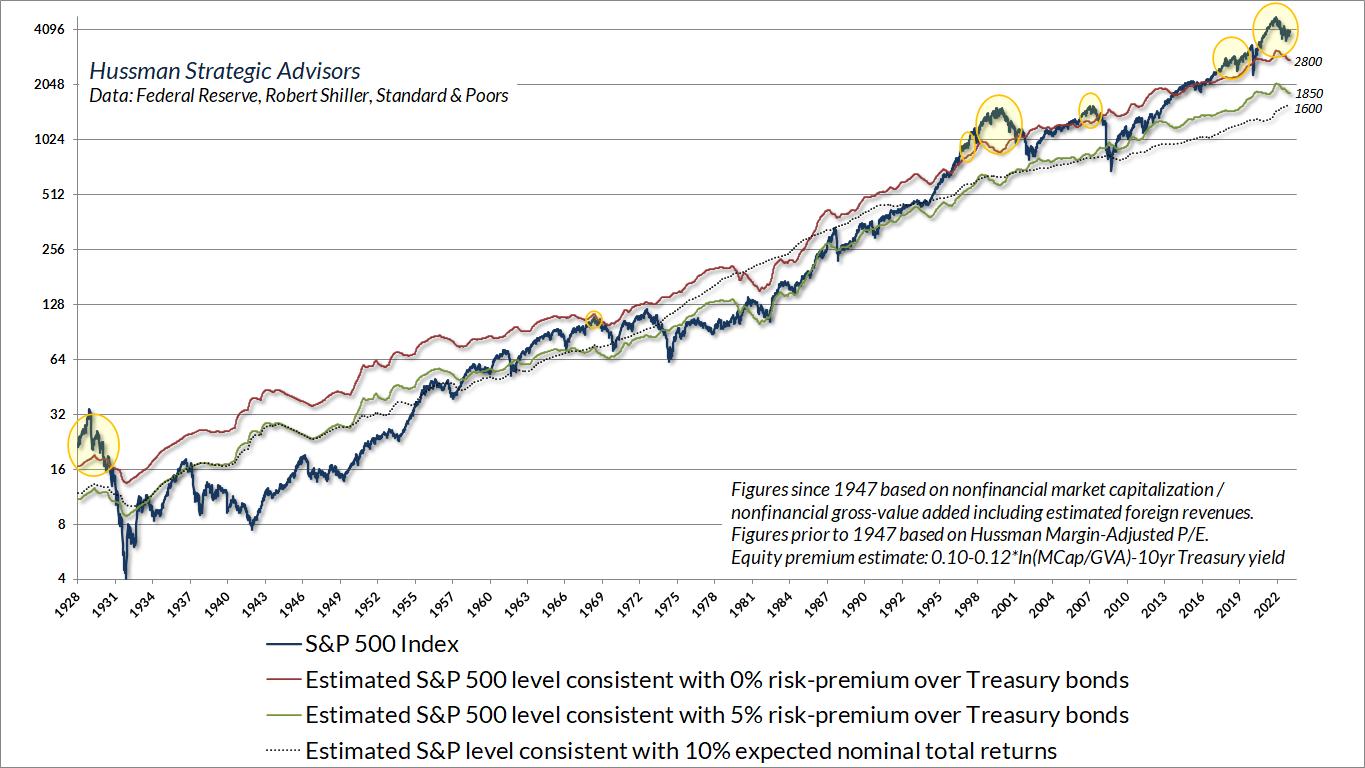

I’ll say this again. Value is not measured by how far prices have declined, but by the relationship between prices and properly discounted cash flows. We presently estimate that the S&P 500 would have to drop to the 2800 level simply to establish prospective 10-year returns equal to those of 10-year Treasury bonds. Restoring a historically run-of-the-mill 5% expected return over-and-above Treasury bond yields would require a decline to the 1850 level. Restoring historically run-of-the-mill 10% expected long-term returns for the S&P 500 would require, by our estimates, a decline to the 1600 level.

Put simply, we estimate that the S&P 500 faces the same prospect of full-cycle loss and return-free risk as it did in 1929, 2000, and 2007. A massive recession is not required. Hyperinflation is not required. A housing collapse is not required. All that is required for a stock market collapse is for investors to demand historically run-of-the-mill prospective returns from stocks, rather than continuing to price stocks at speculative valuations that represented the equivalent of crying “uncle” in the face zero interest rates.

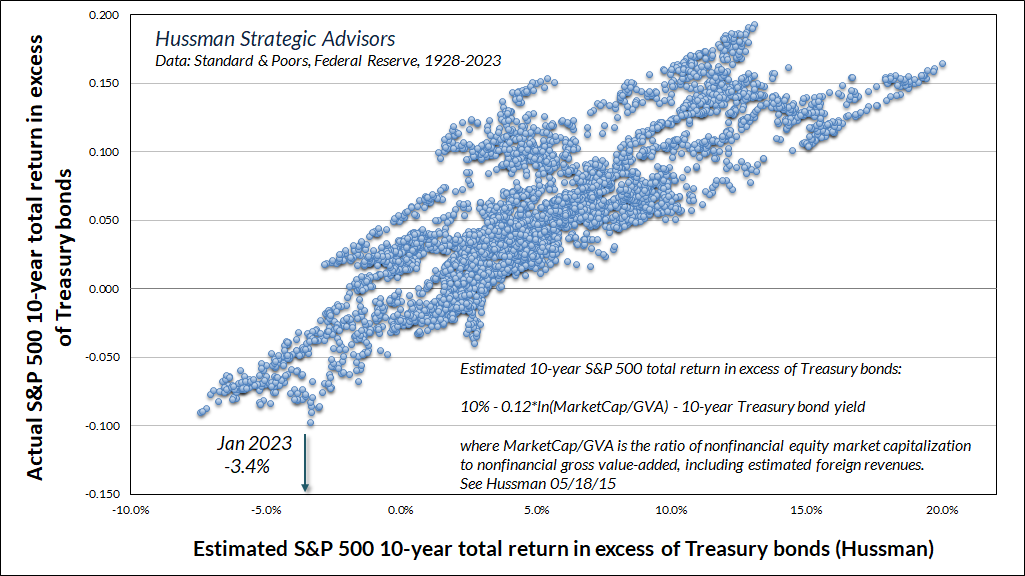

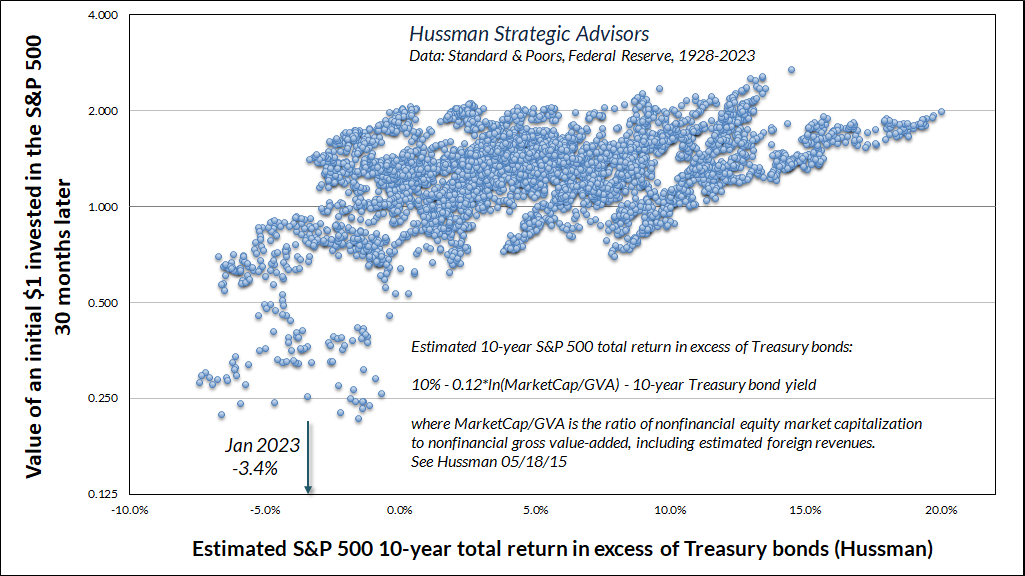

The chart below shows our estimates of S&P 500 total returns in excess of 10-year Treasury yields, along with actual subsequent returns, in data since 1928. You will see lots of “equity risk premium” models on Wall Street. The problem is that, in general, we find that they don’t actually work well at all. That’s certainly true of Wall Street’s naïve favorite: forward operating yield – 10 year bond yield. As I noted last year, it’s also true of the Shiller-Black-Jirav “Excess Cape Yield.”

When you hear Wall Street analysts talking about the attractiveness of stocks versus bonds, it’s imperative to ask whether the model they’re using actually has any meaningful relationship to subsequent returns. It’s one of my great frustrations with this industry that the answer is typically “no.” Below is a measure that does pass that requirement. Unfortunately, we presently estimate that S&P 500 total returns are likely to lag the returns of Treasury bonds by -3.4% annually over the coming decade. Given that the 10-year Treasury bond yield is currently about 3.4%, that also implies that we estimate S&P 500 total returns to average about zero over the coming decade.

Fortunately or unfortunately, periods of negative estimated S&P 500 returns, relative to bonds, don’t tend to persist for long. In general, stocks tend to suffer severe losses over the next 30-36 months. The chart below illustrates this regularity. The horizontal axis shows the estimated S&P 500 total return in excess of 10-year Treasury yields. The vertical shows the value of an original $1 invested in the S&P 500, 30 months later. Notice that the points on the left side of the graph essentially collapse below 1.0. That’s the original investment getting wiped out.

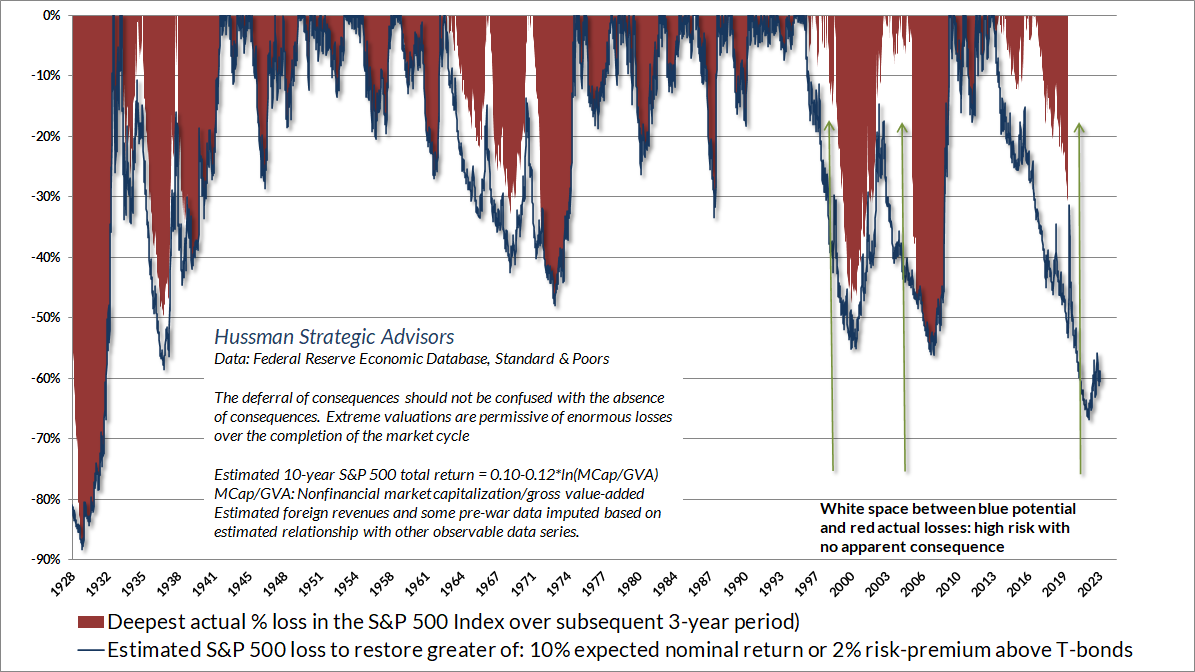

The chart below illustrates the opening sentence of this month’s comment: “The problem with speculation is that there’s usually a gap between the underlying risk and the inevitable outcome.” The blue line shows the estimated loss in the S&P 500 that would be required to restore the greater of a) 10% expected S&P 500 nominal total returns; or b) a 2% expected risk-premium above Treasury bonds. The red shading shows the deepest actual subsequent S&P 500 loss over the following 3-year period. Notice that there’s often quite a bit of “white space” between the blue cups and the red ink that eventually fills them. That white space represents high risk with no apparent consequence; periods that enticed speculators to run across minefields and to push their luck.

Despite the profound risks that we believe are baked into the cake of valuations, I’ll say this again – at any point when our measures of internals suggest that investor psychology has shifted toward speculation, we’ll refrain from adopting or amplifying a bearish market outlook. Indeed, even at current valuations, a shift to uniformly favorable internals would encourage us to adopt a constructive market outlook more often than not (albeit with position limits and safety nets). We understand the valuation risks, but we also understand that there are certain periods when investors could not care less about valuation risks. Our job is to adhere to a value-conscious, historically-informed, risk-managed, full-cycle investment discipline, and we’ve adapted in ways that enable us to respond flexibly to market conditions as they change, without the risk of being “pinned” into any given market outlook.

On recession risk, inflation persistence, and embedded expectations

The National Bureau of Economic Research generally defines recessions as periods in which output, income, spending, and employment retreat in a way that combines depth, diffusion, and duration (though clear weakness in one feature can offset more moderate weakness in another). Currently, my view is that employment hasn’t deteriorated to the extent that would be consistent with NBER recession criteria – at least not yet.

– John P. Hussman, Ph.D., Are We There Yet?, July 2022

As the year begins, it’s common to see various outlooks circulated for 2023. My own view, detailed above, is that market valuations remain the most salient risk for investors, particularly given that interest rates are no longer at zero. It seems extremely optimistic for investors to expect smooth sailing, at valuations that still rival the 1929 and 2000 extremes, yet without the reckless zero-interest rate policies that enabled valuations to exceed 1929 and 2000 extremes in the first place. Still, as always, we’ll respond to market conditions as they change over time, and no forecasts are required.

My view on recession risk remains that employment hasn’t deteriorated to the extent that would be consistent with NBER recession criteria. Despite weakness in various measures of purchasing manager sentiment and credit stress, the employment components of our own Recession Warning Composites have also not yet shifted in a way that suggests an imminent recession.

Given current valuation extremes, I don’t believe that an official recession is necessary for stocks to experience severe losses. I do suspect that we’ll observe something that meets the definition of a recession even if the rate of unemployment rises beyond 4%, but my own expectations regarding the severity of a recession would require more deterioration than we see at present. In addition to employment measures, a steep widening in credit spreads coupled with a deterioration in consumer confidence and aggregate hours worked would contribute to more immediate recession concerns. For now, I don’t have terribly pointed expectations on the subject.

As for inflation, my impression is that investors have gotten far ahead of themselves by extrapolating modest improvement in the data. It may be that inflation improves progressively from here, but the problem is that investors have taken it for granted and embedded it into prices, which means that they now rely on that improvement. Any stall in progress on the inflation front, and particularly any upward surprise in core inflation even on the order of 0.2-0.4%, could be strikingly disruptive to both bonds and stocks.

For my part, I’ve always insisted on forming expectations by examining data. Frankly, there’s no better way than studying inflation data to prove to yourself that Wall Street, main street economists, the financial media, and the Federal Reserve are all spouting opinions completely off the tops of their heads, seemingly incapable of operating the most basic scatterplot.

See, the fact is that nearly everything people imagine is predictive of inflation has virtually no reliable relationship with inflation. That includes unemployment – as I’ve noted before, even the Phillips Curve is essentially a scarcity relationship between unemployment and real wage inflation. It has very little to do with general price inflation. Half of you just got mad at me. Don’t get mad. Come on, look at the data. Get into it. Get deep into it. You’re going to be so disappointed because everything you believe, everything you learned in Economics 101, is theoretical dogma.

Now, there are certainly useful perspectives on inflation – my own framework is to examine four drivers – the quantity of government liabilities (measurable), the demand for and confidence in government liabilities (psychological), the supply of goods and services along with slack capacity (measurable), and the demand for goods and services (psychological). As with the stock market, the psychological elements have a self-reflexive impact. Prices affect expectations, which affect prices. The upshot here is that the best predictor of inflation is, well, inflation, and lagged inflation. The next best correlates, but weaker, are negative economic shocks, and shocks to capacity and supply amid unsustainable government deficits.

So unless we get smacked by recession and credit strains, which aren’t really evident here, my impression is that inflation may be more persistent than investors seem to be banking on. That’s where investors are really getting themselves into danger. Based on historical relationships between interest rates, core inflation, nominal GDP growth, unemployment, and other factors, the lower bound for a “Fed pivot” and the typical lower bound for the 10-year Treasury bond yield are both in the area of 5.2% here. By pricing bonds and other assets in a way that assumes that inflation will come down rapidly and in a straight line, investors have put themselves in the position of relying on inflation to come down rapidly and in a straight line.

That’s not impossible. Can’t rule it out. But it’s not really how inflation tends to resolve. To the contrary, inflation shocks have historically had a strikingly long half-life.

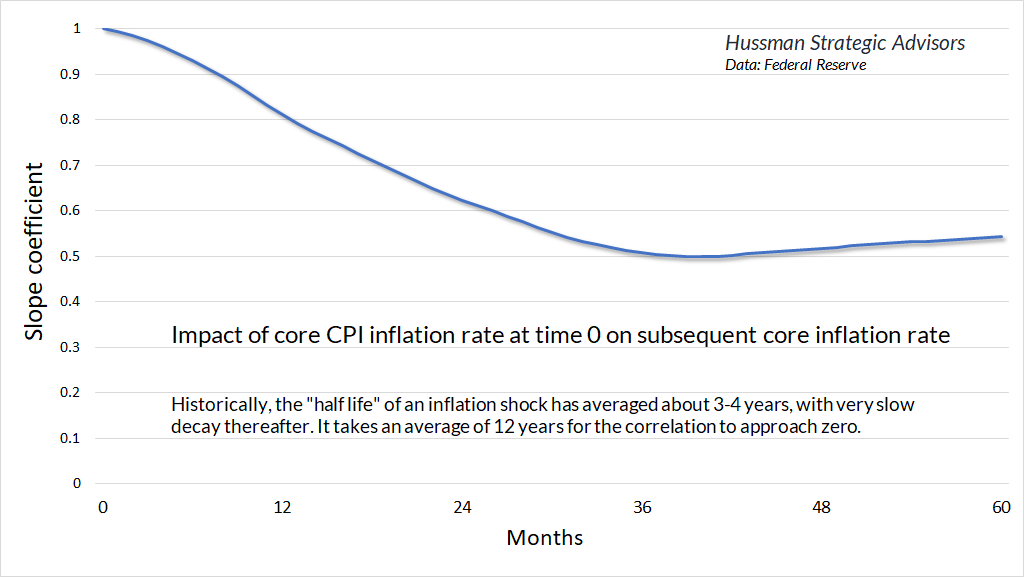

The chart below illustrates this point. The vertical axis shows the slope coefficient relating the current inflation rate to the subsequent year-over-year rate, month by month, over the next 5 years.

Obviously, the highest correlation is in the first 12 months, declining as the overlap in the data declines. But the “half-life” of inflation is actually about 3-4 years, and the correlation between inflation at one point and inflation at another point only approaches zero after about 12 years.

The bottom line is simple. We don’t require forecasts, but investors should not ignore risks or insist on pushing their luck. The present combination of extreme valuations and unfavorable market action creates a “trap door” of downside risk for the financial markets. Likewise, the persistence of extreme valuations – in the absence of the causes and conditions that encouraged those extreme valuations – creates risk. The tendency of negative estimated risk-premiums to resolve into deep market drawdowns over the next 30-36 months creates risk. The reliance of investors on “forward earnings” multiples that embed record profit margins creates risk. The assumption that inflation will come down in a rapid and linear fashion, despite historical persistence of inflation, creates risk.

If our measures of market internals were to improve, we could at least infer that investors had shifted toward a speculative mindset, rather than one inclined toward risk-aversion. Presently, we observe a great deal of potential risk in an overvalued market where investors are also inclined to care about that risk.

Those conditions will change. Until then, we’re comfortably buckled up.

In Honor and Remembrance of Rev. Dr. Martin Luther King Jr.

Martin Luther King deserves a national holiday because he rescued the American people from the shallows and miseries where they had chosen to live their lives. He deserves a national holiday because more than any other public figure in this century he asserted his individuality in order to affirm community on the widest possible scale; because better than any other public figure he understood the nature of compassion, that it did not exclude confrontation. It was Martin’s message that it is not enough to suffer with the poor, we must confront the people and systems that cause poverty. It was Martin’s message that you cannot set the captive free if you are not willing to control those who hold the keys. Without confrontation compassion becomes merely commiseration, fruitless and sentimental. Likewise King understood the difference between defiance and freedom. Confrontation to him did not mean the ruin and humiliation of his opponents. Nonviolence to him represented conquest without the humiliation of the conquered. Nonviolence to him represented an effort to give visibility not to our own poor powers but to God’s everlasting love.

– William Sloane Coffin, Credo

Dr. King noted that he tried to speak on the subject below at least once a year. Preserving that tradition has always seemed an appropriate way to honor him. If you’ve never read Dr. King’s writings, this talk is a good place to start. I don’t think it’s possible to read his words without coming away better for it.

Loving Your Enemies

November 17, 1957

“I want to use as a subject from which to preach this morning a very familiar subject, and it is familiar to you because I have preached from this subject twice before to my knowing in this pulpit. I try to make it a, something of a custom or tradition to preach from this passage of Scripture at least once a year, adding new insights that I develop along the way out of new experiences as I give these messages. Although the content is, the basic content is the same, new insights and new experiences naturally make for new illustrations.

“So I want to turn your attention to this subject: “Loving Your Enemies.” It’s so basic to me because it is a part of my basic philosophical and theological orientation – the whole idea of love, the whole philosophy of love. In the fifth chapter of the gospel as recorded by Saint Matthew, we read these very arresting words flowing from the lips of our Lord and Master: “Ye have heard that it has been said, ‘Thou shall love thy neighbor, and hate thine enemy.’ But I say unto you, Love your enemies, bless them that curse you, do good to them that hate you, and pray for them that despitefully use you; that ye may be the children of your Father which is in heaven.”

“Over the centuries, many persons have argued that this is an extremely difficult command. Many would go so far as to say that it just isn’t possible to move out into the actual practice of this glorious command. But far from being an impractical idealist, Jesus has become the practical realist. The words of this text glitter in our eyes with a new urgency. Far from being the pious injunction of a utopian dreamer, this command is an absolute necessity for the survival of our civilization. Yes, it is love that will save our world and our civilization, love even for enemies.

“Now let me hasten to say that Jesus was very serious when he gave this command; he wasn’t playing. He realized that it’s hard to love your enemies. He realized that it’s difficult to love those persons who seek to defeat you, those persons who say evil things about you. He realized that it was painfully hard, pressingly hard. But he wasn’t playing. We have the Christian and moral responsibility to seek to discover the meaning of these words, and to discover how we can live out this command, and why we should live by this command.

So this morning, as I look into your eyes, and into the eyes of all of my brothers in Alabama and all over America and over the world, I say to you, ‘I love you. I would rather die than hate you.’ And I’m foolish enough to believe that through the power of this love somewhere, men of the most recalcitrant bent will be transformed.

– Reverend Dr. Martin Luther King, Jr.

“Now first let us deal with this question, which is the practical question: How do you go about loving your enemies? I think the first thing is this: In order to love your enemies, you must begin by analyzing self. And I’m sure that seems strange to you, that I start out telling you this morning that you love your enemies by beginning with a look at self. It seems to me that that is the first and foremost way to come to an adequate discovery to the how of this situation.

“Now, I’m aware of the fact that some people will not like you, not because of something you have done to them, but they just won’t like you. But after looking at these things and admitting these things, we must face the fact that an individual might dislike us because of something that we’ve done deep down in the past, some personality attribute that we possess, something that we’ve done deep down in the past and we’ve forgotten about it; but it was that something that aroused the hate response within the individual. That is why I say, begin with yourself. There might be something within you that arouses the tragic hate response in the other individual.

“This is true in our international struggle. Democracy is the greatest form of government to my mind that man has ever conceived, but the weakness is that we have never touched it. We must face the fact that the rhythmic beat of the deep rumblings of discontent from Asia and Africa is at bottom a revolt against the imperialism and colonialism perpetuated by Western civilization all these many years.

“And this is what Jesus means when he said: “How is it that you can see the mote in your brother’s eye and not see the beam in your own eye?” And this is one of the tragedies of human nature. So we begin to love our enemies and love those persons that hate us whether in collective life or individual life by looking at ourselves.

“A second thing that an individual must do in seeking to love his enemy is to discover the element of good in his enemy, and every time you begin to hate that person and think of hating that person, realize that there is some good there and look at those good points which will over-balance the bad points.

“Somehow the “isness” of our present nature is out of harmony with the eternal “oughtness” that forever confronts us. And this simply means this: That within the best of us, there is some evil, and within the worst of us, there is some good. When we come to see this, we take a different attitude toward individuals. The person who hates you most has some good in him; even the nation that hates you most has some good in it; even the race that hates you most has some good in it. And when you come to the point that you look in the face of every man and see deep down within him what religion calls “the image of God,” you begin to love him in spite of. No matter what he does, you see God’s image there. There is an element of goodness that he can never slough off. Discover the element of good in your enemy. And as you seek to hate him, find the center of goodness and place your attention there and you will take a new attitude.

“Another way that you love your enemy is this: When the opportunity presents itself for you to defeat your enemy, that is the time which you must not do it. There will come a time, in many instances, when the person who hates you most, the person who has misused you most, the person who has gossiped about you most, the person who has spread false rumors about you most, there will come a time when you will have an opportunity to defeat that person. It might be in terms of a recommendation for a job; it might be in terms of helping that person to make some move in life. That’s the time you must do it. That is the meaning of love. In the final analysis, love is not this sentimental something that we talk about. It’s not merely an emotional something. Love is creative, understanding goodwill for all men. It is the refusal to defeat any individual. When you rise to the level of love, of its great beauty and power, you seek only to defeat evil systems. Individuals who happen to be caught up in that system, you love, but you seek to defeat the system.

Within the best of us, there is some evil, and within the worst of us, there is some good. The person who hates you most has some good in him; even the nation that hates you most has some good in it; even the race that hates you most has some good in it… No matter what he does, you see God’s image there. There is an element of goodness that he can never slough off.

“The Greek language, as I’ve said so often before, is very powerful at this point. It comes to our aid beautifully in giving us the real meaning and depth of the whole philosophy of love. And I think it is quite apropos at this point, for you see the Greek language has three words for love, interestingly enough. It talks about love as eros. That’s one word for love. Eros is a sort of, aesthetic love. Plato talks about it a great deal in his dialogues, a sort of yearning of the soul for the realm of the gods. And it’s come to us to be a sort of romantic love, though it’s a beautiful love. Everybody has experienced eros in all of its beauty when you find some individual that is attractive to you and that you pour out all of your like and your love on that individual. That is eros, you see, and it’s a powerful, beautiful love that is given to us through all of the beauty of literature; we read about it.

“Then the Greek language talks about philia, and that’s another type of love that’s also beautiful. It is a sort of intimate affection between personal friends. And this is the type of love that you have for those persons that you’re friendly with, your intimate friends, or people that you call on the telephone and you go by to have dinner with, and your roommate in college and that type of thing. It’s a sort of reciprocal love. On this level, you like a person because that person likes you. You love on this level, because you are loved. You love on this level, because there’s something about the person you love that is likeable to you. This too is a beautiful love. You can communicate with a person; you have certain things in common; you like to do things together. This is philia.

“The Greek language comes out with another word for love. It is the word agape. And agape is more than eros; agape is more than philia; agape is something of the understanding, creative, redemptive goodwill for all men. It is a love that seeks nothing in return. It is an overflowing love; it’s what theologians would call the love of God working in the lives of men. And when you rise to love on this level, you begin to love men, not because they are likeable, but because God loves them. You look at every man, and you love him because you know God loves him. And he might be the worst person you’ve ever seen.

“And this is what Jesus means, I think, in this very passage when he says, “Love your enemy.” And it’s significant that he does not say, “Like your enemy.” Like is a sentimental something, an affectionate something. There are a lot of people that I find it difficult to like. I don’t like what they do to me. I don’t like what they say about me and other people. I don’t like their attitudes. I don’t like some of the things they’re doing. I don’t like them. But Jesus says love them. And love is greater than like. Love is understanding, redemptive goodwill for all men, so that you love everybody, because God loves them. You refuse to do anything that will defeat an individual, because you have agape in your soul. And here you come to the point that you love the individual who does the evil deed, while hating the deed that the person does. This is what Jesus means when he says, “Love your enemy.” This is the way to do it. When the opportunity presents itself when you can defeat your enemy, you must not do it.

“Now for the few moments left, let us move from the practical how to the theoretical why. It’s not only necessary to know how to go about loving your enemies, but also to go down into the question of why we should love our enemies. I think the first reason that we should love our enemies, and I think this was at the very center of Jesus’ thinking, is this: that hate for hate only intensifies the existence of hate and evil in the universe. If I hit you and you hit me and I hit you back and you hit me back and go on, you see, that goes on ad infinitum. It just never ends. Somewhere somebody must have a little sense, and that’s the strong person. The strong person is the person who can cut off the chain of hate, the chain of evil. And that is the tragedy of hate – that it doesn’t cut it off. It only intensifies the existence of hate and evil in the universe. Somebody must have religion enough and morality enough to cut it off and inject within the very structure of the universe that strong and powerful element of love.

“I think I mentioned before that sometime ago my brother and I were driving one evening to Chattanooga, Tennessee, from Atlanta. He was driving the car. And for some reason the drivers were very discourteous that night. They didn’t dim their lights; hardly any driver that passed by dimmed his lights. And I remember very vividly, my brother A. D. looked over and in a tone of anger said: “I know what I’m going to do. The next car that comes along here and refuses to dim the lights, I’m going to fail to dim mine and pour them on in all of their power.” And I looked at him right quick and said: “Oh no, don’t do that. There’d be too much light on this highway, and it will end up in mutual destruction for all. Somebody got to have some sense on this highway.”

“Somebody must have sense enough to dim the lights, and that is the trouble, isn’t it? That as all of the civilizations of the world move up the highway of history, so many civilizations, having looked at other civilizations that refused to dim the lights, and they decided to refuse to dim theirs. And Toynbee tells that out of the twenty-two civilizations that have risen up, all but about seven have found themselves in the junk heap of destruction. It is because civilizations fail to have sense enough to dim the lights. And if somebody doesn’t have sense enough to turn on the dim and beautiful and powerful lights of love in this world, the whole of our civilization will be plunged into the abyss of destruction. And we will all end up destroyed because nobody had any sense on the highway of history.

The strong person is the person who can cut off the chain of hate, the chain of evil. And that is the tragedy of hate – that it doesn’t cut it off. It only intensifies the existence of hate and evil in the universe. Somebody must have religion enough and morality enough to cut it off and inject within the very structure of the universe that strong and powerful element of love.

“Somewhere somebody must have some sense. Men must see that force begets force, hate begets hate, toughness begets toughness. And it is all a descending spiral, ultimately ending in destruction for all and everybody. Somebody must have sense enough and morality enough to cut off the chain of hate and the chain of evil in the universe. And you do that by love.

“There’s another reason why you should love your enemies, and that is because hate distorts the personality of the hater. We usually think of what hate does for the individual hated or the individuals hated or the groups hated. But it is even more tragic, it is even more ruinous and injurious to the individual who hates. You just begin hating somebody, and you will begin to do irrational things. You can’t see straight when you hate. You can’t walk straight when you hate. You can’t stand upright. Your vision is distorted. There is nothing more tragic than to see an individual whose heart is filled with hate. He comes to the point that he becomes a pathological case. For the person who hates, you can stand up and see a person and that person can be beautiful, and you will call them ugly. For the person who hates, the beautiful becomes ugly and the ugly becomes beautiful. For the person who hates, the good becomes bad and the bad becomes good. For the person who hates, the true becomes false and the false becomes true. That’s what hate does. You can’t see right. The symbol of objectivity is lost. Hate destroys the very structure of the personality of the hater.

“The way to be integrated with yourself is be sure that you meet every situation of life with an abounding love. Never hate, because it ends up in tragic, neurotic responses. Psychologists and psychiatrists are telling us today that the more we hate, the more we develop guilt feelings and we begin to subconsciously repress or consciously suppress certain emotions, and they all stack up in our subconscious selves and make for tragic, neurotic responses. And may this not be the neuroses of many individuals as they confront life that that is an element of hate there. And modern psychology is calling on us now to love. But long before modern psychology came into being, the world’s greatest psychologist who walked around the hills of Galilee told us to love. He looked at men and said: “Love your enemies; don’t hate anybody.” It’s not enough – to love your friends – because when you start hating anybody, it destroys the very center of your creative response to life and the universe; so love everybody. Hate at any point is a cancer that gnaws away at the very vital center of your life and your existence. It is like eroding acid that eats away the best and the objective center of your life. So Jesus says love, because hate destroys the hater as well as the hated.

“Now there is a final reason I think that Jesus says, “Love your enemies.” It is this: that love has within it a redemptive power. And there is a power there that eventually transforms individuals. That’s why Jesus says, “Love your enemies.” Because if you hate your enemies, you have no way to redeem and to transform your enemies. But if you love your enemies, you will discover that at the very root of love is the power of redemption. You just keep loving people and keep loving them, even though they’re mistreating you. Here’s the person who is a neighbor, and this person is doing something wrong to you and all of that. Just keep being friendly to that person. Keep loving them. Don’t do anything to embarrass them. Just keep loving them, and they can’t stand it too long. Oh, they react in many ways in the beginning. They react with bitterness because they’re mad because you love them like that. They react with guilt feelings, and sometimes they’ll hate you a little more at that transition period, but just keep loving them. And by the power of your love they will break down under the load. That’s love, you see. It is redemptive, and this is why Jesus says love. There’s something about love that builds up and is creative. There is something about hate that tears down and is destructive. So love your enemies.

“There is a power in love that our world has not discovered yet. Jesus discovered it centuries ago. Mahatma Gandhi of India discovered it a few years ago, but most men and most women never discover it. For they believe in hitting for hitting; they believe in an eye for an eye and a tooth for a tooth; they believe in hating for hating; but Jesus comes to us and says, “This isn’t the way.”

“As we look out across the years and across the generations, let us develop and move right here. We must discover the power of love, the power, the redemptive power of love. And when we discover that we will be able to make of this old world a new world. We will be able to make men better. Love is the only way. Jesus discovered that.

“And our civilization must discover that. Individuals must discover that as they deal with other individuals. There is a little tree planted on a little hill and on that tree hangs the most influential character that ever came in this world. But never feel that that tree is a meaningless drama that took place on the stages of history. Oh no, it is a telescope through which we look out into the long vista of eternity, and see the love of God breaking forth into time. It is an eternal reminder to a power-drunk generation that love is the only way. It is an eternal reminder to a generation depending on nuclear and atomic energy, a generation depending on physical violence, that love is the only creative, redemptive, transforming power in the universe.

“So this morning, as I look into your eyes, and into the eyes of all of my brothers in Alabama and all over America and over the world, I say to you, “I love you. I would rather die than hate you.” And I’m foolish enough to believe that through the power of this love somewhere, men of the most recalcitrant bent will be transformed. And then we will be in God’s kingdom.”

Keep Me Informed

Please enter your email address to be notified of new content, including market commentary and special updates.

Thank you for your interest in the Hussman Funds.

100% Spam-free. No list sharing. No solicitations. Opt-out anytime with one click.

By submitting this form, you consent to receive news and commentary, at no cost, from Hussman Strategic Advisors, News & Commentary, Cincinnati OH, 45246. https://www.hussmanfunds.com. You can revoke your consent to receive emails at any time by clicking the unsubscribe link at the bottom of every email. Emails are serviced by Constant Contact.

The foregoing comments represent the general investment analysis and economic views of the Advisor, and are provided solely for the purpose of information, instruction and discourse.

Prospectuses for the Hussman Strategic Growth Fund, the Hussman Strategic Total Return Fund, the Hussman Strategic International Fund, and the Hussman Strategic Allocation Fund, as well as Fund reports and other information, are available by clicking “The Funds” menu button from any page of this website.

Estimates of prospective return and risk for equities, bonds, and other financial markets are forward-looking statements based the analysis and reasonable beliefs of Hussman Strategic Advisors. They are not a guarantee of future performance, and are not indicative of the prospective returns of any of the Hussman Funds. Actual returns may differ substantially from the estimates provided. Estimates of prospective long-term returns for the S&P 500 reflect our standard valuation methodology, focusing on the relationship between current market prices and earnings, dividends and other fundamentals, adjusted for variability over the economic cycle. Further details relating to MarketCap/GVA (the ratio of nonfinancial market capitalization to gross-value added, including estimated foreign revenues) and our Margin-Adjusted P/E (MAPE) can be found in the Market Comment Archive under the Knowledge Center tab of this website. MarketCap/GVA: Hussman 05/18/15. MAPE: Hussman 05/05/14, Hussman 09/04/17.