Pushing Extremes

John P. Hussman, Ph.D.

President, Hussman Investment Trust

November 2020

The one reality that you can never change is that a higher-priced asset will produce a lower return than a lower-priced asset. You can’t have your cake and eat it. You can enjoy it now, or you can enjoy it steadily in the distant future, but not both – and the price we pay for having this market go higher and higher is a lower 10-year return from the peak.

– Jeremy Grantham, CNBC, November 12, 2020

In calling the current market the third “Real McCoy” bubble of recent decades, Jeremy Grantham described, in his own words, what I call the Iron Law of Valuation: a security is nothing more than a claim on some set of future cash flows that investors expect to be delivered into their hands over time. The higher the price an investor pays today for some amount of cash in the future, the lower the long-term return the investor can expect on that investment.

However, there’s a difference between those long-term return prospects, which are driven by valuations and discounted cash flows, and short-term return prospects, which are driven by the psychology of investors – particularly their inclination toward speculation or risk-aversion. I talk about this in terms of market internals. Grantham describes it as a “psychological node.” We may navigate that aspect of the financial markets in different ways, but both of us recognize that the long-term prospects implied by valuations don’t condense into short-term implications for market direction.

For example, investors may very well be willing to pay $100 today in return for an expected $100 cash flow a decade from now. Sure, doing so will essentially lock in an expected return of zero, but nothing prevents rabid speculators from driving the price to $110 in the short run. In that case, investors will be thrilled with the current price, but they will simultaneously be locking in negative prospective 10-year returns.

Conversely, risk-averse investors may drive the price down to $46 today, in which case current holders will be distressed and upset. Yet that’s also a price from which they can expect to obtain an 8% annual return over the subsequent decade.

It’s exactly these dynamics Grantham is describing when he says, “You can enjoy it now, or you can enjoy it steadily in the distant future, but not both – and the price we pay for having this market go higher and higher is a lower 10-year return from the peak.”

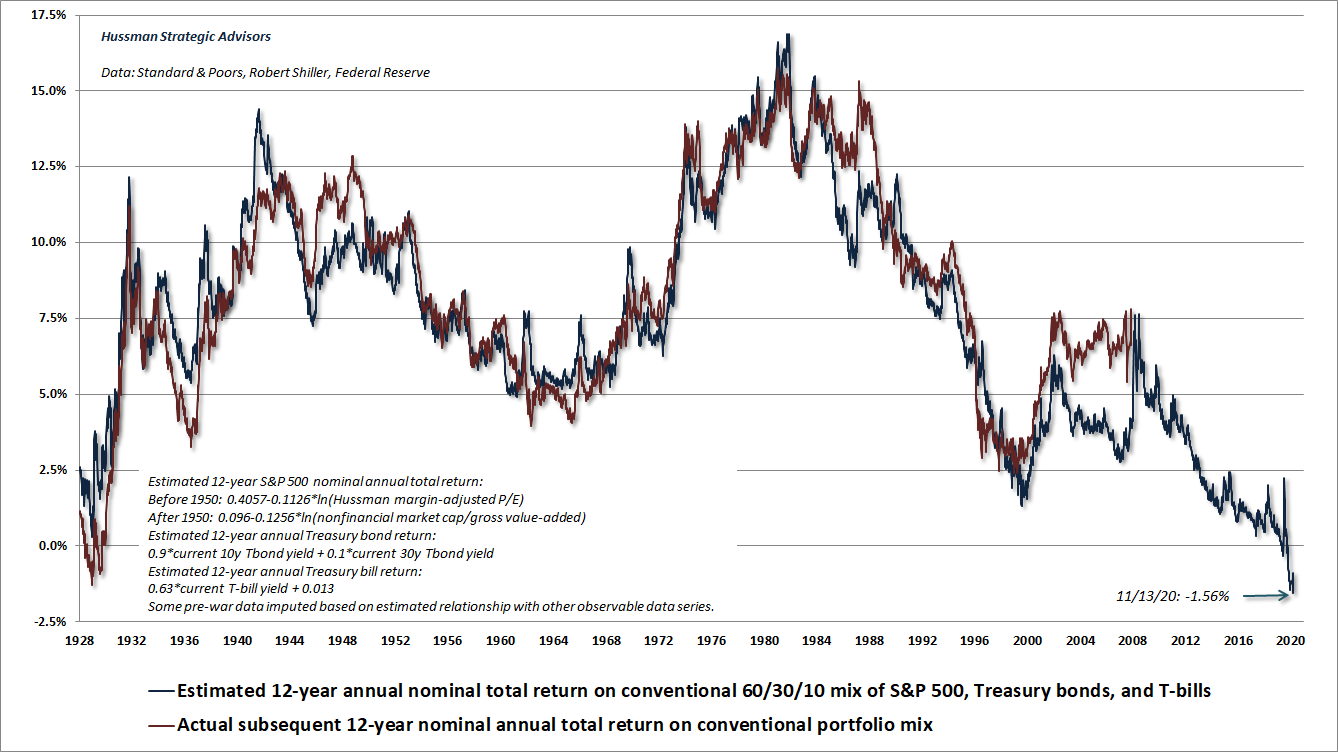

In that context, it’s worth understanding what the present combination of depressed interest rates and extreme market valuations implies for long-term and full-cycle investment returns. The chart below shows our estimate of 12-year nominal average annual total returns for a passive investment mix invested 60% in the S&P 500, 30% in Treasury bonds, and 10% in Treasury bills. In nearly a century of data, including the market extremes of 1929 and 2000, this estimate has never been lower than it is today. The red line (which of course ends 12 years ago) shows the actual subsequent 12-year total return on that same portfolio mix across history.

It’s worth understanding that the largest drag on this portfolio mix is the equity component, which is more negative than at any prior point in history. I’m not terribly surprised that Grantham is presently advising a zero allocation to U.S. stocks here. As I noted in last month’s comment, our own measures of market internals indicate that speculators do have the bit in their teeth, but with such extremely overextended technicals and lopsided bullish sentiment that our outlook is essentially neutral, and I continue to view safety nets and tail-risk hedges as essential.

The early evidence on SARS-CoV-2 vaccines, particularly for mRNA (messenger RNA) candidates, has been very good, though it reflects preliminary interim findings presented in press releases. Once a complete set of Phase 3 data become available, the financial markets may be sensitive to even the smallest details, even brief post-injection side effects, so expect some volatility. In any event, I’m very encouraged about the mRNA vaccines, despite some logistics that will be required to maintain the cold chain between manufacture and vaccine administration.

With regard to the financial markets, the “vaccine announcement” days have been divergent, as they provoke abrupt changes in the “thesis” of investors. Aside from those short-term responses, the longer-term challenge is this. Even once a safe, effective vaccine is available, the very long-term stream of corporate cash flows will not suddenly jump above pre-pandemic highs. Yet valuations are already at the most extreme levels in history, even when we calculate valuations based on pre-pandemic fundamentals.

The driving force behind the markets here isn’t valuation, and it isn’t economic growth (aside from the usual mean-reversion of the GDP output gap). Instead, it’s that “psychological node” of investors. You can’t stand in front of people and say, “no, stop, don’t.” For us, the best response is to maintain a willingness to adopt a constructive outlook with a safety-net (as we’ve done at certain points this year) particularly when the market retreats but internals remain constructive, and to be content with a neutral outlook at points of extreme overextension.

All of this is another way of saying that we’re not actively fighting speculation here, but we’re also well aware of how closely the speculative features of this market resemble the pre-crash peaks of August 1929 and March 2000, as well as lesser ones like January 1972 August 1987, and October 2007. If we can establish a combination of favorable internals and a moderate retreat in valuations, we would be inclined toward a more constructive outlook (still with a safety net). Here and now, we’re content to be buckled up without being explicitly “bearish.”

Again, even at extreme valuations, we’re open to adopting a constructive near-term outlook (with a safety net) from time to time, provided that positive market internals aren’t accompanied by extreme overextension. We may adopt a more neutral outlook otherwise, but we don’t adopt or amplify an outright bearish outlook except when we observe deterioration or divergence in our measures of market internals. I do believe that there’s far more underlying economic and credit strain incubating beneath the Potemkin Village of stock market behavior than investors realize, so it’s important to attend to credit spreads and other signs of risk-aversion.

It’s not necessary to predict when market conditions will change, only to respond to them as they do. At present extremes, the risk of a severe air-pocket, panic, or crash is elevated, yet we don’t currently have the deterioration in market internals that would encourage an outright bearish outlook.

We’re not actively fighting speculation here, but we’re also well aware of how closely the speculative features of this market resemble the pre-crash peaks of August 1929 and March 2000, as well as lesser extremes like January 1972, August 1987, and October 2007.

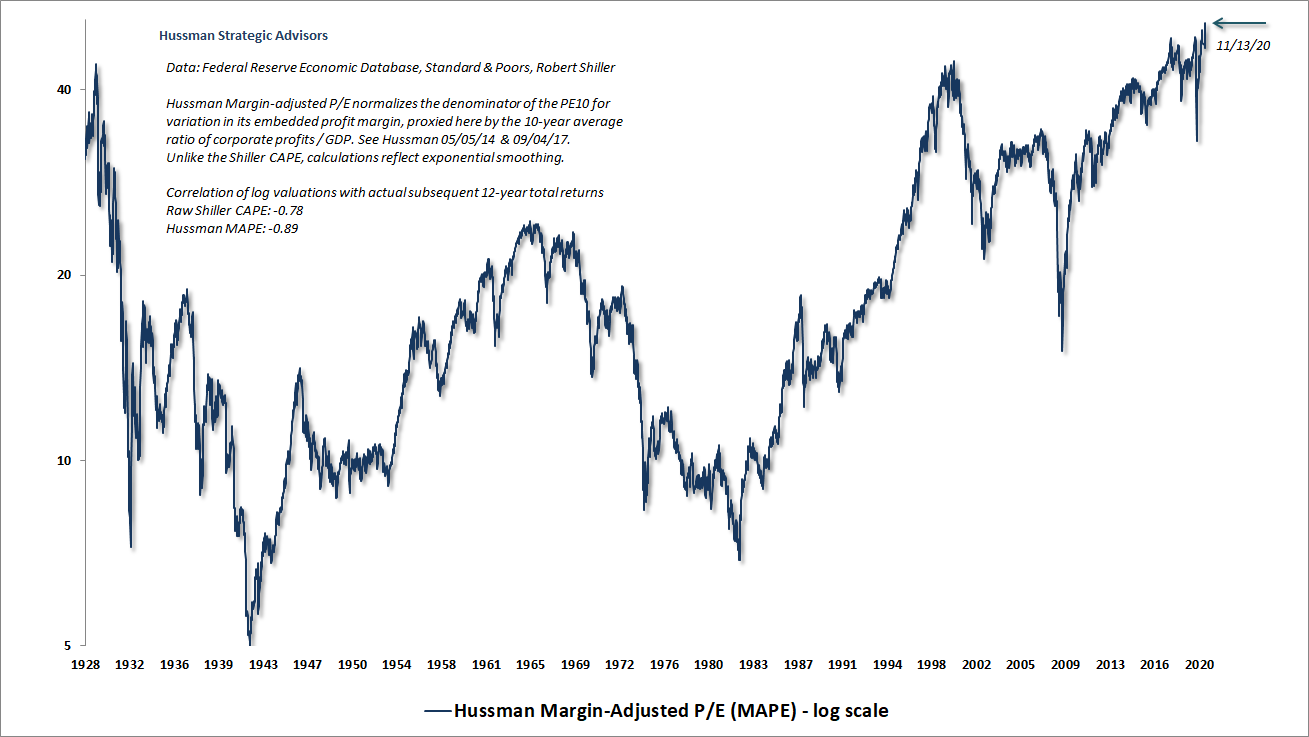

The chart below shows our Margin-Adjusted P/E (MAPE), which is better correlated with actual subsequent market returns than nearly every measure we’ve tested or evaluated, aside from our measure of market capitalization to corporate gross-value added (MarketCap/GVA). The MAPE has a longer data history, which allows us to make an important point here. The valuation of U.S. stocks has never been more extreme, even at the 1929 and 2000 market peaks. I should add that I’ve intentionally excluded the impact of pandemic GDP and profit weakness, which would otherwise make this measure even more extreme.

I continue to expect the S&P 500 Index to lose two-thirds of its value over the completion of the current market cycle. That loss would not even breach historical valuation norms, but it would at least bring our estimates of long-term expected S&P 500 returns closer to their historical average, in contrast to the negative 10-12 year prospects we observe at present. Nothing in our investment discipline requires that outcome, but I do expect it.

In any event, I believe our adaptations in recent years have restored our ability to effectively navigate a persistently overvalued market (even if we remain neutral at its most speculative points). That ability to navigate complete market cycles is something I built a reputation for across decades, prior to the distortions introduced by quantitative easing. I’m pleased that the effects of our late-2017 adaptations are gradually becoming more evident in the work we do.

Even at extreme valuations, we’re open to adopting a constructive near-term outlook (with a safety net) from time to time, provided that positive market internals aren’t accompanied by extreme overextension. We may adopt a more neutral outlook otherwise, but we don’t adopt or amplify an outright bearish outlook except when we observe deterioration or divergence in our measures of market internals.

When even T-bills have higher investment prospects

I realize that investors are under the impression that low interest rates “justify” current valuation extremes. It’s essential to understand what is actually being argued here. Saying that low interest rates “justify” extreme valuations doesn’t mean these extremes are fine, and that investors can expect satisfactory returns to follow. Oh, no, no. It’s just an argument that dismal expected returns in bonds should be accompanied by dismal expected returns in stocks as well. It’s like saying that poking yourself in the eye justifies smashing your thumb with a hammer. Well, congratulations. That’s exactly where we are.

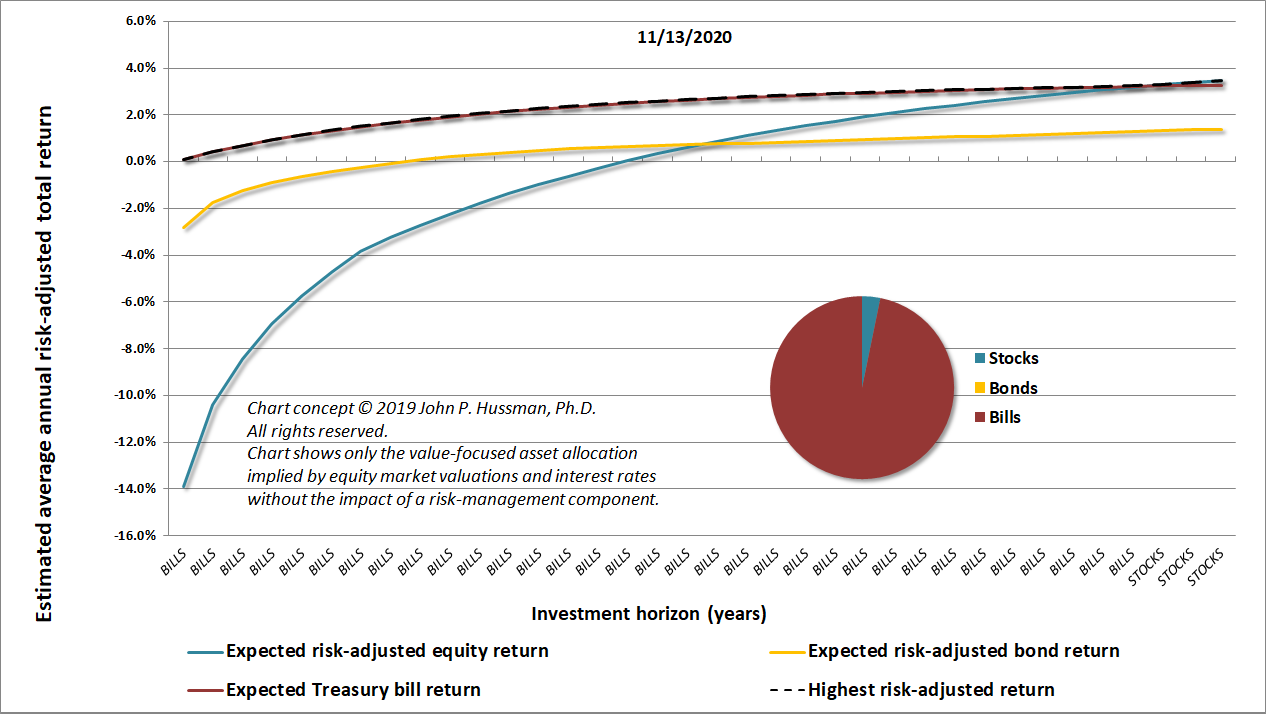

In a 2019 white paper, I detailed an approach to estimate a “value-focused asset allocation” by jointly considering prevailing stock market valuations and interest rates. It specifies an investment allocation based on which asset class is estimated to have the highest average annual expected return, adjusted for risk, to each point in a long-term investment horizon. That allocation can then be modified by a risk-management component, to adjust exposure during segments of the market cycle where risk-aversion or speculation among market participants may temporarily drive valuations to depressed or elevated levels. The white paper shows how this value-focused asset allocation has changed across market history, particularly at important peaks and troughs in the stock and bond markets.

The chart below shows this value-focused asset allocation based on current interest rates and S&P 500 valuations (not including the impact of a risk-management considerations based on market internals, overextended conditions, and other factors). Even assuming that Treasury bill yields don’t rise beyond 3% even 30 years from now, the value-focused allocation presently allocates virtually nothing to stocks. Emphatically, even with interest rates near zero, this is the single lowest allocation to the S&P 500 implied by our value-focused asset allocation approach since July 2007, when the S&P 500 was within 1% of the bull market peak that preceded the market collapse of the global financial crisis. That’s not to say that the market has necessarily peaked, but it’s a warning that investors should not place too much faith in “low interest rates” as a justification for taking substantial market risk here.

One of the remarkable features of financial television is the single-minded focus of its talking heads on the latest move – their full-fledged immersion in the now. In contrast, the thinking of a disciplined value-investor is primarily on the long-term and the complete cycle. Our measures of market internals are certainly helpful in navigating shorter periods of speculation and risk-aversion. Still, investors who abandon the Iron Law of Valuation are inviting a world of pain.

Take a set of future cash flows and the current price of those cash flows: the relationship between the two reflects the rate of return that investors can expect to attain over time. That’s not a theory, it’s just arithmetic.

The CNBC interview with Jeremy Grantham offered a striking example of the difference between long-term and short-term thinking. Even as Grantham reiterated the extreme valuation concerns he discussed a few months ago, the interviewer countered, “Markets have risen since then. Why are you still convinced?”

Grantham responded, “Actually, it works quite the other way around. The more spectacular the rise, and the longer it goes, the more certainty one can have that you’re in a real McCoy bubble.”

At the most extreme valuations in history, that proposition might, and should, be obvious, but it simply did not compute in the short-term thinking of the anchors – one whose furrowed brow and scrunched facial expressions vacillated between annoyance, ridicule, and derision. The post-interview discussion instead included this interchange:

“I mean, last time around when you talked to him and he called it a bubble, it did seem a little more plausible. It seems like he’s doubling down.”

“You start to weigh out the possibilities that he could be missing a further rally in the markets.”

Oh, man. The unwinding of this bubble is going to be painful.

Public health note

We’ve gone off book again.

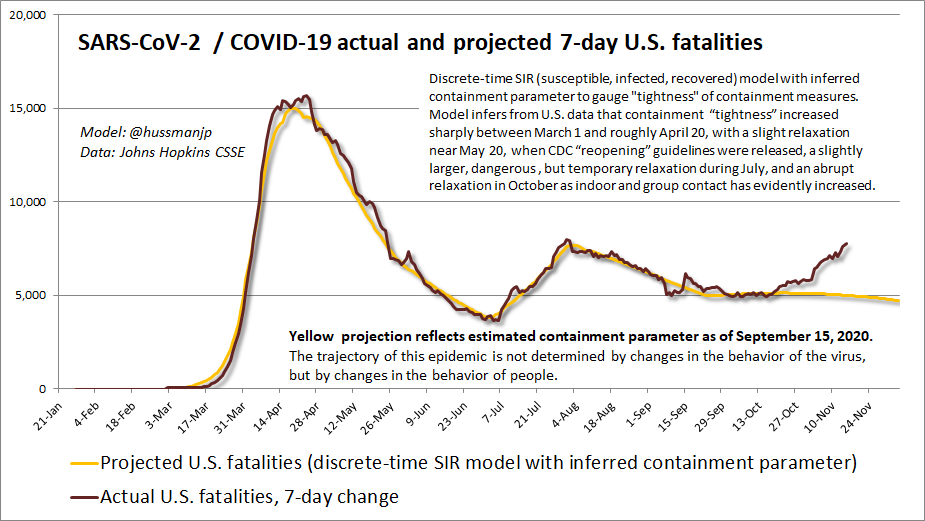

The red line in the chart below shows the 7-day total of U.S. COVID-19 fatalities. The orange line is the projection based on our estimate of containment “tightness” as of September 15, 2020. It’s important to understand that while viruses can have a certain level of seasonality, that’s more true of influenza viruses than coronaviruses. For the most part, the trajectory of the epidemic is not determined by changes in the behavior of the virus, but by changes in the behavior of people. Nothing about this curve is deterministic, as long as we are capable of changing our behavior.

I know you’re exhausted by this epidemic. I am too. But we’re in a critical window here, in the space where potentially safe, effective vaccines are in now sight, but still months before they will be widely available.

Early interim results for two mRNA vaccines are particularly encouraging. The fact that the leading candidates are not narrowly focused on the viral spike receptor-binding domain (RBD) is a positive in my view. Instead, both of the mRNA candidates encode the full-length spike protein, with modifications to stabilize it in a pre-fusion conformation. Without launching into immunology, I’m hopeful about that design. I’ll write more later on the considerations involved here. For those familiar with my scientific work at the Hussman Foundation, I’ve got a forthcoming paper discussing some of this – a companion to the one I published earlier this year in Frontiers in Pharmacology.

Unfortunately, we do have time to discuss vaccines in another comment – and that’s the problem. In the best case, we won’t have broad vaccine availability until the first quarter of 2021, but we’ve launched into an acceleration of the epidemic here and now. That means that this moment – in the interim when a vaccine is in sight but is not yet available – is the most important opportunity to save lives.

As I detailed in Avoiding a Second Wave and Herd Mentality, there are three critical variables that define the spread of an epidemic, and inform efforts to limit it: the probability that contact with an infected person results in transmission, the number of people that an infected person comes into contact with during the period they remain infective, and the duration of the infective period itself.

Fortunately, there are effective ways of slowing or stopping an epidemic, and we can literally read them right out of the arithmetic:

- Reduce the probability that contact with an infected person will transmit the disease, which is where the use of face masks in shared indoor public airspace is critical, along with increased person-to-person distance, shorter interactions, and hygiene like hand washing and disinfecting common touchpoints;

- Reduce the number of contacts and social interactions, particularly involving “superspreading” events where one infected person can come into contact with lots of uninfected people, and “hub” locations where previously isolated groups of people come together and mix;

- Reduce the duration of infectivity, by quickly isolating new cases and tracing their recent contacts, in order to prevent transmission to additional people.

– John P. Hussman, Ph.D., Avoiding a Second Wave, July 30 2020

Containment involves a broad combination of behaviors, each that contributes to reducing transmission. Context also matters. If you wear a mask all the time, except during indoor meals and extended conversation in bars and restaurants, and while doing wind-sprints at the gym next to people from different areas that you’re not isolating with, well, there’s your trouble. Conversely, if you’re taking a walk in an outdoor park where you’re not close to other people, masks are a lower priority except possibly in passing.

Events that bring large numbers of people together into a hub from diverse locations, particularly indoors with conversation, dancing, and other forceful exhalation, are at high risk of being superspreader events. At minimum, keep group sizes low and stable, use a mask or distance yourself during conversation with others you haven’t regularly been with, and open some windows to increase airflow.

If you wouldn’t have swapped a piece of chewed gum with a random stranger, no questions asked, before the pandemic, yeah, you should probably wear a mask during the pandemic. Keep in mind that the infective ability of SARS-CoV-2 is far higher than other pathogens. Measles and pertussis are notable exceptions, so other vaccinations – especially those – are essential even amid a global pandemic.

Containment doesn’t require “lockdown.” It doesn’t impose a violation of individual “liberty.” It just asks that we care enough about others to avoid needless fatalities. Again, here’s containment in a nutshell:

1) Reduce the probability that contact with other people results in transmission (masks, distancing, shorter interactions, airflow, hygiene);

2) Reduce the number of people you come into close contact with (limited and stable groups, reducing unnecessary travel, avoiding hub and superspreader events);

3) Reduce the duration of infectivity (isolating if you learn you’ve been exposed, testing, contact tracing).

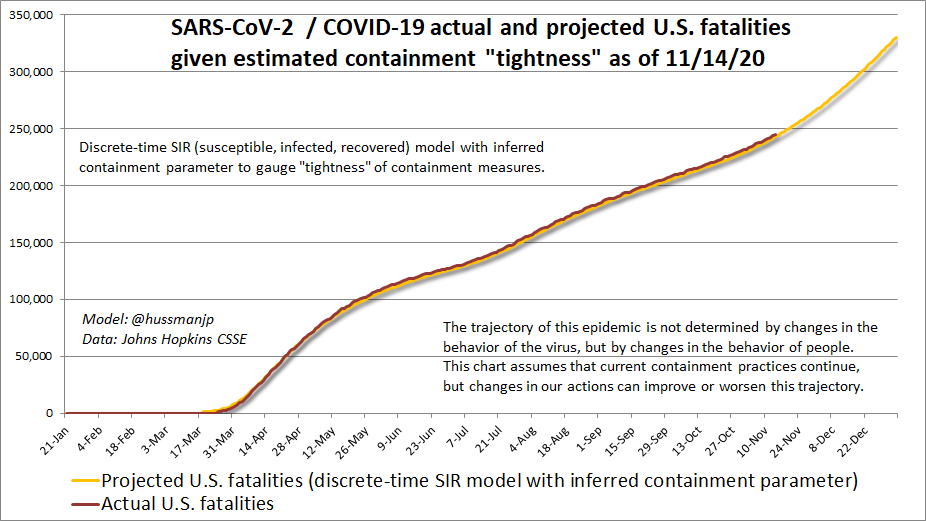

The chart below shows the trajectory we’re currently on, based on the current level of containment “tightness” that can be inferred from the data. Unless we alter our containment behavior, which we absolutely can, the U.S. is now on course to lose another 75,000 lives by year-end to a disease that causes suffocation, thrombosis, and organ failure. These people will never again hug their children; never again watch another sunset; never again laugh with their friends. Far more people – friends, family members, and many otherwise healthy adults with no preconditions – will suffer diffuse inflammatory damage to lung tissue and blood vessel linings, which I suspect is what drives symptoms that have been labeled “long-COVID.” We have the capacity to reduce that number, not by shutting down the economy, but just by maybe accepting a little bit of inconvenience. What is it that makes this so difficult?

Half of the U.S. population has never understood that the point of all these efforts is to reduce the size of the infective pool enough for tight local containment of new cases (testing, isolation, contact tracing) to be successful. It’s exactly that success of local containment that allows a country to minimize and avoid population-wide measures. It’s exactly that success that allows a country to quickly reopen. It never happened in the United States. The dismissive rhetoric never gave us a chance.

Unless we alter our containment behavior, which we absolutely can, the U.S. is now on course to lose another 75,000 lives by year-end to a disease that causes suffocation, thrombosis, and organ failure. These people will never again hug their children; never again watch another sunset; never again laugh with their friends. Far more people – friends, family members, and many otherwise healthy adults with no preconditions – will suffer diffuse inflammatory damage to lung tissue and blood vessel linings.

Having regularly posted on the SARS-CoV-2 pandemic since February 2, when the U.S. had just 5 cases and 0 fatalities, the past several months have been like watching a brutal, deadly, avoidable, slow-motion train wreck. I’ve lost the patience to entertain the endless deflection of responsibility, the misguided thinking that conflates every reasonable containment effort with “lockdown,” and the chorus of dismissive “buhwhatabout” questions focused on anything that provides an excuse to ignore nearly 250,000 U.S. fatalities.

Again, containment should not be conflated with “lockdown.” I’m hopeful that we can recruit enough singularity of purpose to avoid one (though technically, we never had a properly coordinated lockdown in the first place). The best and most effective use of “lockdown” isn’t at a late stage like this anyway, except in places where transmission rates become untenable. The best opportunity was at the very first sign of this pandemic. Had that happened earlier, it didn’t even need to be long. Just enough for testing, isolation, and contact tracing to be coordinated, so that local containment of new cases could be successful. We were too late, and then too impatient, to achieve that “handoff” to local whack-a-mole. Yet that’s exactly how China, South Korea, Thailand, New Zealand, and Singapore quickly brought the pandemic under control. That ship has sailed. Still, it’s not too late to avoid thousands upon thousands of additional fatalities.

Say it with me. Containment is not lockdown. It’s just a basic act of respect for the lives of others.

On the mode of leadership

From my perspective, the problem isn’t politics. A civil society can work out those differences. The immediate problem, and the danger, is the mode of leadership itself. A leader can call forth either the ‘better angels of our nature’ or the worst ones. I am troubled for our nation and for the world because of the example of coarse incivility, mean-spirited treatment of others, disingenuous speech, thin temperament, self-aggrandizing vanity, puerile character, overbearing arrogance, habitual provocation, and broad disrespect toward other nations, races, and religions that is now on display as our country’s model of leadership. Even in the face of our differences, it’s important that we refuse to resign ourselves to passively accepting or normalizing this model. A dismissive regard for truth, civility, transparency, ethics, and process is dangerous because it creates potential for unaccountable, corrupt and arbitrary government. I believe that the people of our nation are both decent and vigilant enough to openly and loudly reject this behavior even where they might agree with various policy directions.

– John P. Hussman, Ph.D., On Governance, January 30, 2017

This has been a contentious several years, and recent weeks have been challenging for everybody. More than ever, it’s worth remembering – many of the people on the other “side” are also the very first people who would reach out to help us in need. They’re the first people who would step up to defend our country, teach our children, assist a neighbor, or care for us in the hospital.

No, this trouble we’re having isn’t about politics. It’s not because the other “side” is full of bad people. It’s because all of us have the capacity of being called to our better angels, or to our worst instincts. The mode of leadership matters. It’s something that other societies have had to contend with at critical moments in history. Sometimes they’ve failed spectacularly. The only thing that offers protection from slipping into an ocean of bad instinct is commitment to principles – civility, compassion, kindness, honesty, equality, human rights, peace.

Jimmy Carter, who still ministers at a Baptist church in Plains, doesn’t talk about peace as some ideal. He talks about peace as an active and dedicated mission, using the phrase “waging peace.” Thich Nhat Hanh teaches that peace isn’t just a goal, but a commitment and a prerequisite that begins with at least one person; “It is my conviction that there is no way to peace – peace is the way.” He uses the phrase “interbeing” to describe our connectedness; the understanding that all of us are part of a single fabric of shared humanity. It’s what Rev. Dr. Martin Luther King Jr. described as our “inescapable network of mutuality, tied in a single garment of destiny.”

I’ve admittedly struggled daily to restore my peace in recent weeks. I’ve clicked the “Block” link on Twitter far more than usual. The thing that offered the most protection was to have a minister, a reverend, and a monk as role models. All of us need others who can speak to our better angels, and we should be aware when someone is pulling us instead to our worst instincts (even when some of them out there happen, bewilderingly, to be ministers, reverends, or monks).

The problem isn’t that the “other side” is bad – it’s that all of us are malleable. That’s what allows very good people to say or do very unkind things when they’re called to their worst selves instead of their better ones. It’s our principles, and only our principles, that stand in the way. The moment we’re willing to surrender principles like civility, compassion, kindness, honesty, equality, human rights, and peace because it helps us to achieve short-run policy gains, we’re toast. A mode of leadership that diminishes those principles is itself a form of policy, and it’s far more corrosive.

If there’s one lesson I’ve repeated in recent years, is that there’s no limit to the extremes a crowd will accept and rationalize in the short-run if it serves their immediate interests. It’s the long-run that unavoidably suffers. That’s as true in other areas of life as it is in finance. It’s the consequences that we’re going to have to grapple with. Listening to our better angels seems a good first step.

A principle is an approach you stick with even if you know it might lead to a short-term outcome you don’t prefer. Especially then. It’s this gap between the short-term and the long-term that makes a principle valuable. If your guiding principle is to do whatever benefits you right now, you don’t have principles of much value.

– Seth Godin (h/t Jesse Felder)

Keep Me Informed

Please enter your email address to be notified of new content, including market commentary and special updates.

Thank you for your interest in the Hussman Funds.

100% Spam-free. No list sharing. No solicitations. Opt-out anytime with one click.

By submitting this form, you consent to receive news and commentary, at no cost, from Hussman Strategic Advisors, News & Commentary, Cincinnati OH, 45246. https://www.hussmanfunds.com. You can revoke your consent to receive emails at any time by clicking the unsubscribe link at the bottom of every email. Emails are serviced by Constant Contact.

The foregoing comments represent the general investment analysis and economic views of the Advisor, and are provided solely for the purpose of information, instruction and discourse.

Prospectuses for the Hussman Strategic Growth Fund, the Hussman Strategic Total Return Fund, the Hussman Strategic International Fund, and the Hussman Strategic Allocation Fund, as well as Fund reports and other information, are available by clicking “The Funds” menu button from any page of this website.

Estimates of prospective return and risk for equities, bonds, and other financial markets are forward-looking statements based the analysis and reasonable beliefs of Hussman Strategic Advisors. They are not a guarantee of future performance, and are not indicative of the prospective returns of any of the Hussman Funds. Actual returns may differ substantially from the estimates provided. Estimates of prospective long-term returns for the S&P 500 reflect our standard valuation methodology, focusing on the relationship between current market prices and earnings, dividends and other fundamentals, adjusted for variability over the economic cycle.