When Speculation Has No Limits

John P. Hussman, Ph.D.

President, Hussman Investment Trust

Interim Comment: January 15, 2018

Last week, Investors Intelligence reported the most lopsided bullish extreme in over 30 years, with 64.4% of investment advisors bullish and just 13.5% bearish. Likewise, the Daily Sentiment Index for both S&P 500 and Nasdaq futures reached the most extreme levels in their history.

Regardless of the condition of market internals, and even during the half-cycle since 2009, the S&P 500 has lost value, on average, when we’ve observed the combination of: 1) a bull/bear ratio of even 2-to-1, currently more than 4.7-to-1; 2) rich valuations – anything above a Shiller P/E of 18, though even the current level of 30 understates the valuation extremes here, and; 3) overbought conditions – for simplicity, let’s say an S&P 500 Index anywhere more than 7.5% above its 200-day average.

Despite the far more extreme combination of conditions at present, our immediate market outlook remains neutral, not negative, though I continue to believe that it’s reasonable to pair a flat position with a small “tail risk” hedge several percent below current levels.

Our reasons for this investment outlook aren’t new. Since we adhere to a very specific discipline, our discussion of the reasons behind any particular investment stance necessarily involves a review of the key considerations of our discipline. Presently, I can’t think of a more important discussion, because I expect these key distinctions to matter enormously to investors over the completion of this cycle.

In prior market cycles across history, the emergence of various syndromes of “overvalued, overbought, overbullish” conditions reliably warned that speculation had essentially run its course. Those syndromes helped to anticipate steep market losses even before market internals had deteriorated explicitly. Indeed, on much broader criteria, the syndromes we currently observe are identical to the ones that marked the 1973, 1987, 2000 and 2007 market peaks.

Because of that historical reliability, the methods that emerged from our 2009-2010 stress-testing exercise raised the priority of these “overvalued, overbought, overbullish” syndromes. After admirably navigating multiple complete market cycles, including two of the steepest bubbles and collapses since the Great Depression, history convinced me that certain syndromes of market conditions were sufficiently extreme and offensive that they created a barrier to further speculation. Unfortunately, zero interest rate policy and post-election enthusiasm disrupted that history, and encouraged relentless speculation in recent years despite the repeated emergence of these syndromes. In hindsight, the stupidest thing I ever did as a professional investor was to imagine that there was some limit to the stupidity of Wall Street.

That comment may not seem terribly humble, but as a dear friend and mentor once told me “There’s a difference between humility and false humility.” Sometimes you have to speak your truth if you believe it will be helpful to someone, even if others don’t want to hear it. I’ve got no antidote for those who believe that the dot-com bubble, the housing bubble, or the current “everything bubble” are more than a salad of reckless speculation, herd mentality, and fear of missing out. Having anticipated the collapse of the other two bubbles, and correctly projecting the extent of those losses, it’s clear that my error in this bubble was to underestimate the tenacity of blind speculation (and fail to take advantage of it). The error wasn’t overlooking some kind of justified or durable legitimacy to this madness. As I wrote at the March 2000 bubble peak, just before the S&P 500 dropped by half, and the Nasdaq lost four-fifths of its value, “On Wall Street, urgent stupidity has one terminal symptom, and it is the belief that money is free.” Here we are again.

Fortunately, it’s possible to distinguish between a market that’s prone to speculation and one that’s prone to risk-aversion. When investors are inclined to speculate, they tend to be indiscriminate about it. For that reason, the best measure of that psychological preference toward speculation or risk-aversion is what I often call the “uniformity” of market internals – a signal that we draw from the joint behavior of thousands of securities of varying risk. Though we observed some early dispersion in these measures late last year (the most notable divergences currently being in interest-sensitive securities), we’ve limited ourselves to a neutral – not bearish – investment outlook here, until we observe broader deterioration in those measures of market internals.

It’s worth emphasizing this point. In recent years, we’ve adapted our discipline to fully restore the priority of market internals above “overvalued, overbought, overbullish” syndromes. In the face of overextended extremes, we can take a flat, neutral outlook, but we do not adopt a strongly bearish outlook unless market internals have deteriorated explicitly. In 2014, we made that adaptation, but applied it only to zero interest rate conditions. Last year, we prioritized market internals above those syndromes with no exceptions. The fact that we introduced that adaptation incrementally in recent years may make it seem as if there has been no adaptation to our discipline at all, but that’s an illusion. I expect that time will show that soon enough, and patience will prove valuable.

Our present methods are actually inclined to encourage aggressive or constructive market exposure in more than 70% of periods across history, and would have done so only slightly less frequently during the recent half-cycle since 2009. “Aggressive” here means a fully unhedged position, possibly using call options to provide modest leverage. “Constructive” means a stance that expects to benefit from market advances, but also carries a safety net in one form or another. If you understand the adaptations we’ve made in recent years, these investment stances will not come as a surprise when we adopt them.

Still, don’t underestimate the profound damage that can be done to the market during that remaining 30% of market conditions. I remain adamant that it is not necessary for investors to expose themselves to market risk in periods of rich valuations and deteriorating market internals, particularly coming off of overvalued, overbought, overbullish extremes. Extraordinary market losses can emerge during those periods, and I fully expect the collapse of this speculative half-cycle to follow that historical script.

The most historically reliable valuation measures we identify now stand more than 2.9 times the level we expect them to revisit over the completion of the current market cycle. Yes, that implies a seemingly preposterous loss of over -65% in the S&P 500, most likely over the coming 2-3 years. Then again, my March 2000 projection that technology stocks stood to lose -83% seemed equally preposterous, but that turned out to be the actual loss in the tech-heavy Nasdaq 100 between that point and October 2002.

Over the past 5 years, the revenues of S&P 500 technology companies have grown at a compound annual rate of 12%, while the corresponding stock prices have soared by 56% annually. Over time, price/revenue ratios come back in line. Currently, that would require an 83% plunge in tech stocks (recall the 1969-70 tech massacre). The plunge may be muted to about 65% given several years of revenue growth. If you understand values and market history, you know we’re not joking.

– John P. Hussman, Ph.D., March 7, 2000

Valuations matter enormously for long-term market outcomes (on the order of 10-12 years), and for the projection of potential market losses over the completion of any given cycle. The only complication is that valuations are almost entirely useless in gauging market prospects over shorter segments of the cycle when investors have a speculative bit in their teeth.

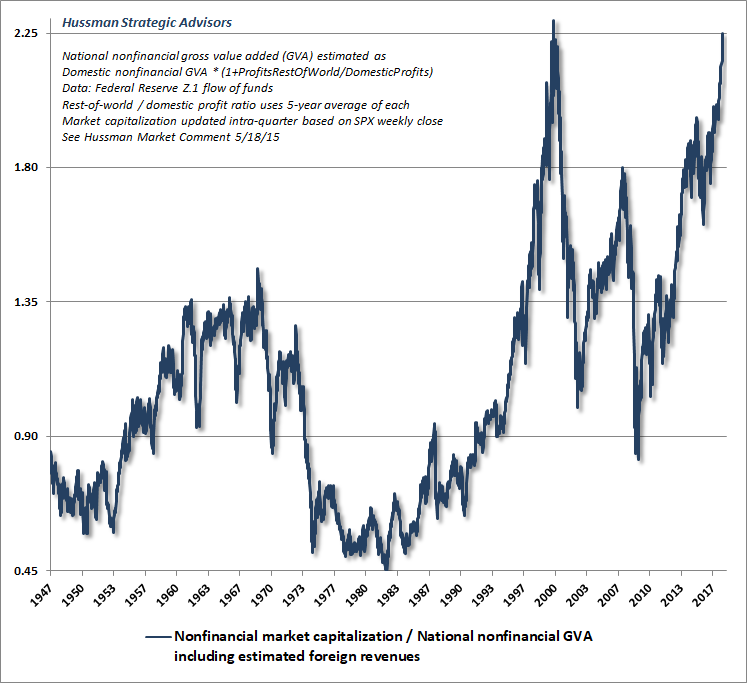

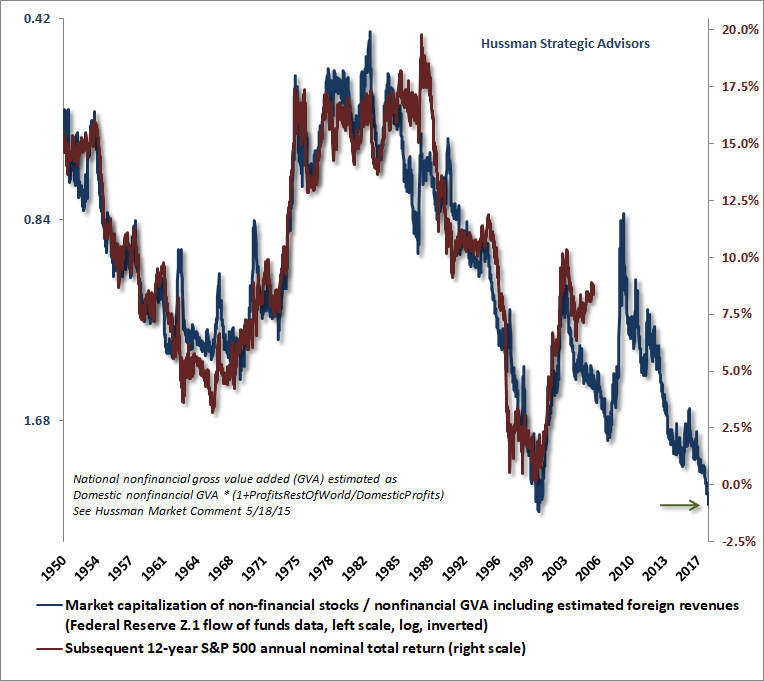

The following charts will provide an indication of where the most reliable valuation measures we identify stand at present. The first is our preferred measure, which I introduced in 2015. MarketCap/GVA is the ratio of nonfinancial market capitalization to corporate gross value-added, including estimated foreign revenues. This measure now stands just shy of the 2000 extreme.

The correlation between (log) MarketCap/GVA and actual subsequent 10-12 year market returns is -0.92, a stronger correlation than any other valuation measure we’ve examined across history. The blue line below shows MarketCap/GVA on an inverted log scale (left). The red line shows actual subsequent 12-year S&P 500 annual total returns (right). Presently, the current extreme implies negative expected S&P 500 total returns over the coming 12-year period.

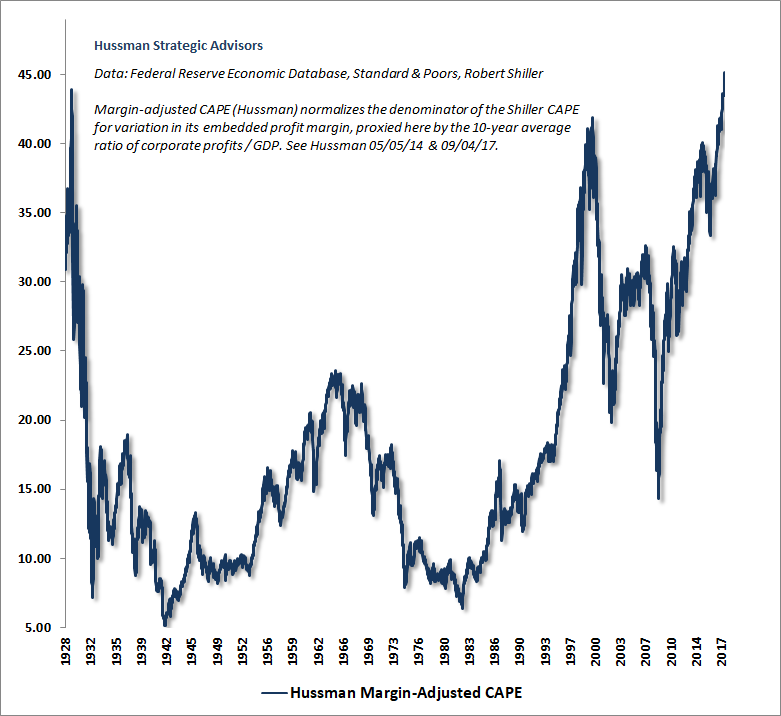

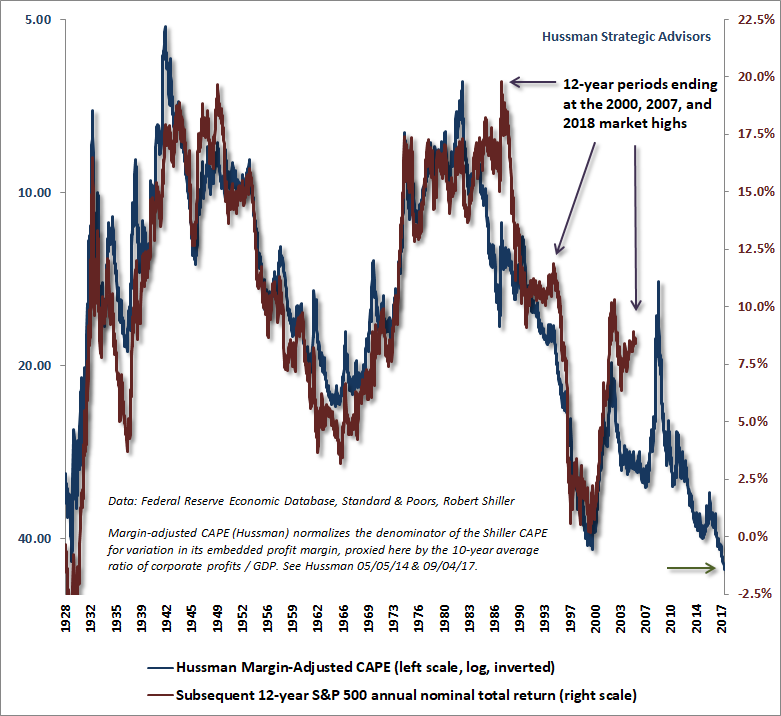

The next measure is my Margin-Adjusted CAPE, which improves the correlation of the Shiller cyclically-adjusted P/E with subsequent returns by accounting for variation in the embedded profit margin. This measure is now beyond both the 1929 and 2000 extremes, placing current market valuations at the richest level in U.S. history. To understand why such valuations aren’t “justified” by low interest rates, reduced taxes, or other factors, see Why Market Valuations Are Not Justified By Low Interest Rates, Survival Tactics for a Hypervalued Market, and other data and analysis I’ve presented in recent months.

One of the benefits of the Margin-Adjusted CAPE is its relatively long history. The chart below shows the relationship between this measure of valuation and actual subsequent 12-year S&P 500 total returns. Notice that “errors” in the model are invariably the result of extreme valuations at the end of a given 12-year period. Indeed, as I observed in my January 2018 comment, these deviations are tightly correlated to cyclical extremes in consumer confidence, which typically wash out over the completion of the market cycle.

It’s essential to distinguish between valuations, which have long-term implications, and the “uniformity” of market internals, which has implications for shorter segments of the market cycle. In both 2000 and 2007, extreme valuations encouraged my seemingly preposterous suggestions that the S&P 500 stood to lose nearly half its value over the completion of those cycles. It was not durable economic fundamentals or “justified” valuation that drove the market to those extremes. It was speculation. Once market internals deteriorated, we correctly drew the signal that those extremes were vulnerable to collapse. Notably, even since 2009, the market has lost value, on average, in periods where overvalued, overbought, overbullish conditions were joined by unfavorable market internals. As long as market internals are prioritized, that combination of factors has remained as effective as ever.

So here we are, nearly three times the level at which I expect the S&P 500 to complete this cycle. Yet even though I expect the market to lose nearly two-thirds of its value over the completion of this cycle, our immediate outlook remains neutral. If we observe a retreat in the most extreme overbought features of the market, and provided relatively low option market volatility and fairly intact market internals, we could even be inclined – if only for a modest period of time – toward a net investment stance that more resembles a call option than a flat position. In any event, I believe that inexpensive tail-risk hedges should be set several percent below current levels, which is where our measures of market internals would most likely shift to a hard-negative condition. We would not rely on “stop loss” orders, however, as the ability to actually execute is likely to become a problem once the market turns lower.

To be clear, we’ve adopted a flat, neutral outlook at present. Still, if overbought conditions were to ease by a few percent without a clear deterioration in market internals, we wouldn’t object to a constructive investment outlook, provided a safety net and ideally something that might benefit in the event that severe tail risks unfold. We would not, however, even dream of carrying an unhedged investment stance, which is unfortunately the position that most investors, retirees, and pension funds have adopted.

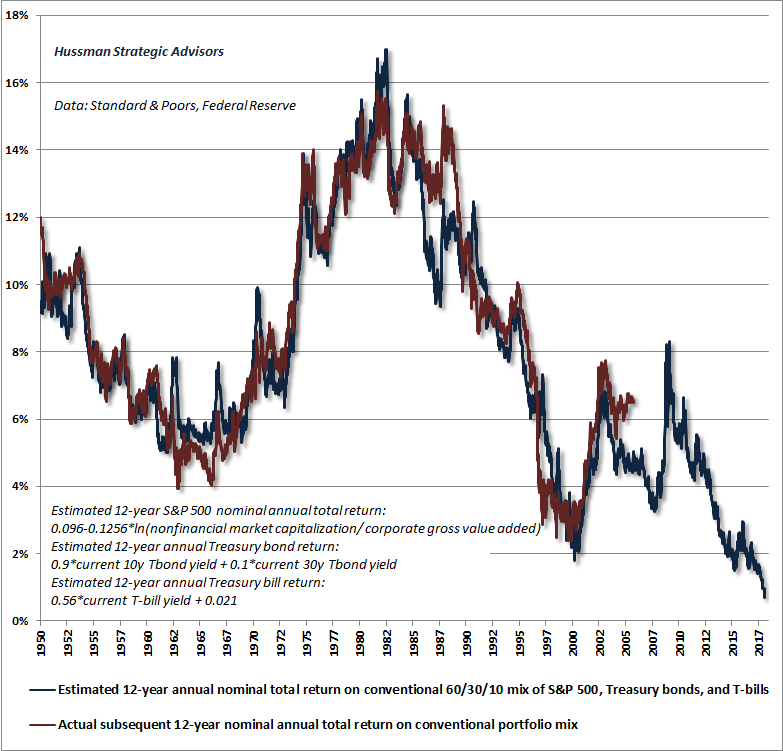

The chart below shows our best estimate of prospective 12-year total returns for a conventional portfolio invested 60% in the S&P 500, 30% in Treasury bonds, and 10% in Treasury bills. At present, valuations in both the stock and bond markets are sufficiently extreme to drive the overall estimated return to less than 1% annually. These are the worst estimated investment prospects for passive investors in history, and I expect they will create enormous difficulties for pension funds as they unfold.

When someone says “stocks are reasonably priced relative to bonds,” what they really mean (perhaps inadvertently) is that both are priced at steep valuations that imply similarly dismal long-term returns. Still, these prospects will likely change over the completion of the current market cycle. Of course, we fully expect that investors who passively lock in current valuations and return prospects will experience overall portfolio losses between now and then.

Keep three things in mind: 1) valuations, which drive the long-term and full-cycle outlook; 2) market internals, which capture shorter-horizon speculative pressures, and 3) extreme overvalued, overbought, overbullish conditions, which are capable of holding us to a neutral outlook, but not an outright negative one until market internals deteriorate explicitly.

My comments from the 2000 and 2007 market peaks (just prior to market collapses of -50% and -55%, respectively) will illustrate the discipline I’ve advocated here.

The information contained in earnings, balance sheets and economic releases is only a fraction of what is known by others. The action of prices and trading volume reveals other important information that traders are willing to back with real money. This is why trend uniformity is so crucial to our Market Climate approach. Historically, when trend uniformity has been positive, stocks have generally ignored overvaluation, no matter how extreme. When the market loses that uniformity, valuations often matter suddenly and with a vengeance. This is a lesson best learned before a crash rather than after one. Valuations, trend uniformity, and yield pressures are now uniformly unfavorable, and the market faces extreme risk in this environment.”

– John P. Hussman, Ph.D., October 3, 2000

The key thing to remember is that valuations appear to be irrelevant when investors are inclined toward speculation, and then matter with a vengeance when that psychological disposition gives way to risk-aversion. Avoid the temptation of believing that just because prices have reached a certain level, they must actually belong there. Instead, use valuations to envision the “big picture” – expectations for long-term investment prospects, and potential risks over the completion of the cycle.

Understanding valuations helps to identify when safety nets and tail-risk hedges are appropriate (as they are now). Still, recognize that outcomes over shorter segments of the market cycle are driven primarily by investor psychology, which we infer from market internals. At the point that investor preferences shift toward risk-aversion, much of this imaginary “paper wealth” will be consumed by a large ball of flames, and investors who imagined that current valuations were somehow “justified” will re-learn the same lesson that other speculative cycles should have taught.

One of the best indications of the speculative willingness of investors is the ‘uniformity’ of positive market action across a broad range of internals. Probably the most important aspect of last week’s decline was the decisive negative shift in these measures. Since early October of last year, I have at least generally been able to say in these weekly comments that “market action is favorable on the basis of price trends and other market internals.” Now, it also happens that once the market reaches overvalued, overbought and overbullish conditions, stocks have historically lagged Treasury bills, on average, even when those internals have been positive (a fact which kept us hedged). Still, the favorable market internals did tell us that investors were still willing to speculate, however abruptly that willingness might end. Evidently, it just ended, and the reversal is broad-based.

– John P. Hussman, Ph.D., July 30, 2007

In Honor and Remembrance of Dr. Martin Luther King, Jr.

Dr. King noted that he tried to speak on the subject below at least once a year. That still seems an appropriate way to honor him. If you’ve never read Dr. King’s writings, this talk is a good place to start.

In a world so urgently in need of peace and civility, it’s equally urgent to recognize that answering hatred with hatred never leads to that goal. My friend and teacher Thich Nhat Hanh, who was nominated for the Nobel Peace Prize by Dr. King, has often said “There is no way to peace. Peace is the way.” The first peaceful step always begins with the recognition by each side that the person they would call their enemy also suffers. In our common humanity, each of us might be like the other if we had suffered the same way – whether that suffering takes the form of injustice, poverty, violence, abuse, or even ignorance. In a world where people – on both sides of the word “enemy” – seem so inclined to carelessly pour their reservoir of suffering onto others without recognizing their shared humanity, our best cause for hope still resides in the wisdom of peacemakers like Dr. King. One can’t read his words without coming away better for it.

Loving Your Enemies

November 17 1957

“I want to use as a subject from which to preach this morning a very familiar subject, and it is familiar to you because I have preached from this subject twice before to my knowing in this pulpit. I try to make it a, something of a custom or tradition to preach from this passage of Scripture at least once a year, adding new insights that I develop along the way out of new experiences as I give these messages. Although the content is, the basic content is the same, new insights and new experiences naturally make for new illustrations.

“So I want to turn your attention to this subject: “Loving Your Enemies.” It’s so basic to me because it is a part of my basic philosophical and theological orientation – the whole idea of love, the whole philosophy of love. In the fifth chapter of the gospel as recorded by Saint Matthew, we read these very arresting words flowing from the lips of our Lord and Master: “Ye have heard that it has been said, ‘Thou shall love thy neighbor, and hate thine enemy.’ But I say unto you, Love your enemies, bless them that curse you, do good to them that hate you, and pray for them that despitefully use you; that ye may be the children of your Father which is in heaven.”

“Over the centuries, many persons have argued that this is an extremely difficult command. Many would go so far as to say that it just isn’t possible to move out into the actual practice of this glorious command. But far from being an impractical idealist, Jesus has become the practical realist. The words of this text glitter in our eyes with a new urgency. Far from being the pious injunction of a utopian dreamer, this command is an absolute necessity for the survival of our civilization. Yes, it is love that will save our world and our civilization, love even for enemies.

“Now let me hasten to say that Jesus was very serious when he gave this command; he wasn’t playing. He realized that it’s hard to love your enemies. He realized that it’s difficult to love those persons who seek to defeat you, those persons who say evil things about you. He realized that it was painfully hard, pressingly hard. But he wasn’t playing. We have the Christian and moral responsibility to seek to discover the meaning of these words, and to discover how we can live out this command, and why we should live by this command.

So this morning, as I look into your eyes, and into the eyes of all of my brothers in Alabama and all over America and over the world, I say to you, ‘I love you. I would rather die than hate you.’ And I’m foolish enough to believe that through the power of this love somewhere, men of the most recalcitrant bent will be transformed.

– Reverend Dr. Martin Luther King, Jr.

“Now first let us deal with this question, which is the practical question: How do you go about loving your enemies? I think the first thing is this: In order to love your enemies, you must begin by analyzing self. And I’m sure that seems strange to you, that I start out telling you this morning that you love your enemies by beginning with a look at self. It seems to me that that is the first and foremost way to come to an adequate discovery to the how of this situation.

“Now, I’m aware of the fact that some people will not like you, not because of something you have done to them, but they just won’t like you. But after looking at these things and admitting these things, we must face the fact that an individual might dislike us because of something that we’ve done deep down in the past, some personality attribute that we possess, something that we’ve done deep down in the past and we’ve forgotten about it; but it was that something that aroused the hate response within the individual. That is why I say, begin with yourself. There might be something within you that arouses the tragic hate response in the other individual.

“This is true in our international struggle. Democracy is the greatest form of government to my mind that man has ever conceived, but the weakness is that we have never touched it. We must face the fact that the rhythmic beat of the deep rumblings of discontent from Asia and Africa is at bottom a revolt against the imperialism and colonialism perpetuated by Western civilization all these many years.

“And this is what Jesus means when he said: “How is it that you can see the mote in your brother’s eye and not see the beam in your own eye?” And this is one of the tragedies of human nature. So we begin to love our enemies and love those persons that hate us whether in collective life or individual life by looking at ourselves.

“A second thing that an individual must do in seeking to love his enemy is to discover the element of good in his enemy, and every time you begin to hate that person and think of hating that person, realize that there is some good there and look at those good points which will over-balance the bad points.

“Somehow the “isness” of our present nature is out of harmony with the eternal “oughtness” that forever confronts us. And this simply means this: That within the best of us, there is some evil, and within the worst of us, there is some good. When we come to see this, we take a different attitude toward individuals. The person who hates you most has some good in him; even the nation that hates you most has some good in it; even the race that hates you most has some good in it. And when you come to the point that you look in the face of every man and see deep down within him what religion calls “the image of God,” you begin to love him in spite of. No matter what he does, you see God’s image there. There is an element of goodness that he can never slough off. Discover the element of good in your enemy. And as you seek to hate him, find the center of goodness and place your attention there and you will take a new attitude.

“Another way that you love your enemy is this: When the opportunity presents itself for you to defeat your enemy, that is the time which you must not do it. There will come a time, in many instances, when the person who hates you most, the person who has misused you most, the person who has gossiped about you most, the person who has spread false rumors about you most, there will come a time when you will have an opportunity to defeat that person. It might be in terms of a recommendation for a job; it might be in terms of helping that person to make some move in life. That’s the time you must do it. That is the meaning of love. In the final analysis, love is not this sentimental something that we talk about. It’s not merely an emotional something. Love is creative, understanding goodwill for all men. It is the refusal to defeat any individual. When you rise to the level of love, of its great beauty and power, you seek only to defeat evil systems. Individuals who happen to be caught up in that system, you love, but you seek to defeat the system.

Within the best of us, there is some evil, and within the worst of us, there is some good. The person who hates you most has some good in him; even the nation that hates you most has some good in it; even the race that hates you most has some good in it… No matter what he does, you see God’s image there. There is an element of goodness that he can never slough off.

“The Greek language, as I’ve said so often before, is very powerful at this point. It comes to our aid beautifully in giving us the real meaning and depth of the whole philosophy of love. And I think it is quite apropos at this point, for you see the Greek language has three words for love, interestingly enough. It talks about love as eros. That’s one word for love. Eros is a sort of, aesthetic love. Plato talks about it a great deal in his dialogues, a sort of yearning of the soul for the realm of the gods. And it’s come to us to be a sort of romantic love, though it’s a beautiful love. Everybody has experienced eros in all of its beauty when you find some individual that is attractive to you and that you pour out all of your like and your love on that individual. That is eros, you see, and it’s a powerful, beautiful love that is given to us through all of the beauty of literature; we read about it.

“Then the Greek language talks about philia, and that’s another type of love that’s also beautiful. It is a sort of intimate affection between personal friends. And this is the type of love that you have for those persons that you’re friendly with, your intimate friends, or people that you call on the telephone and you go by to have dinner with, and your roommate in college and that type of thing. It’s a sort of reciprocal love. On this level, you like a person because that person likes you. You love on this level, because you are loved. You love on this level, because there’s something about the person you love that is likeable to you. This too is a beautiful love. You can communicate with a person; you have certain things in common; you like to do things together. This is philia.

“The Greek language comes out with another word for love. It is the word agape. And agape is more than eros; agape is more than philia; agape is something of the understanding, creative, redemptive goodwill for all men. It is a love that seeks nothing in return. It is an overflowing love; it’s what theologians would call the love of God working in the lives of men. And when you rise to love on this level, you begin to love men, not because they are likeable, but because God loves them. You look at every man, and you love him because you know God loves him. And he might be the worst person you’ve ever seen.

“And this is what Jesus means, I think, in this very passage when he says, “Love your enemy.” And it’s significant that he does not say, “Like your enemy.” Like is a sentimental something, an affectionate something. There are a lot of people that I find it difficult to like. I don’t like what they do to me. I don’t like what they say about me and other people. I don’t like their attitudes. I don’t like some of the things they’re doing. I don’t like them. But Jesus says love them. And love is greater than like. Love is understanding, redemptive goodwill for all men, so that you love everybody, because God loves them. You refuse to do anything that will defeat an individual, because you have agape in your soul. And here you come to the point that you love the individual who does the evil deed, while hating the deed that the person does. This is what Jesus means when he says, “Love your enemy.” This is the way to do it. When the opportunity presents itself when you can defeat your enemy, you must not do it.

“Now for the few moments left, let us move from the practical how to the theoretical why. It’s not only necessary to know how to go about loving your enemies, but also to go down into the question of why we should love our enemies. I think the first reason that we should love our enemies, and I think this was at the very center of Jesus’ thinking, is this: that hate for hate only intensifies the existence of hate and evil in the universe. If I hit you and you hit me and I hit you back and you hit me back and go on, you see, that goes on ad infinitum. It just never ends. Somewhere somebody must have a little sense, and that’s the strong person. The strong person is the person who can cut off the chain of hate, the chain of evil. And that is the tragedy of hate – that it doesn’t cut it off. It only intensifies the existence of hate and evil in the universe. Somebody must have religion enough and morality enough to cut it off and inject within the very structure of the universe that strong and powerful element of love.

“I think I mentioned before that sometime ago my brother and I were driving one evening to Chattanooga, Tennessee, from Atlanta. He was driving the car. And for some reason the drivers were very discourteous that night. They didn’t dim their lights; hardly any driver that passed by dimmed his lights. And I remember very vividly, my brother A. D. looked over and in a tone of anger said: “I know what I’m going to do. The next car that comes along here and refuses to dim the lights, I’m going to fail to dim mine and pour them on in all of their power.” And I looked at him right quick and said: “Oh no, don’t do that. There’d be too much light on this highway, and it will end up in mutual destruction for all. Somebody got to have some sense on this highway.”

“Somebody must have sense enough to dim the lights, and that is the trouble, isn’t it? That as all of the civilizations of the world move up the highway of history, so many civilizations, having looked at other civilizations that refused to dim the lights, and they decided to refuse to dim theirs. And Toynbee tells that out of the twenty-two civilizations that have risen up, all but about seven have found themselves in the junk heap of destruction. It is because civilizations fail to have sense enough to dim the lights. And if somebody doesn’t have sense enough to turn on the dim and beautiful and powerful lights of love in this world, the whole of our civilization will be plunged into the abyss of destruction. And we will all end up destroyed because nobody had any sense on the highway of history.

The strong person is the person who can cut off the chain of hate, the chain of evil. And that is the tragedy of hate – that it doesn’t cut it off. It only intensifies the existence of hate and evil in the universe. Somebody must have religion enough and morality enough to cut it off and inject within the very structure of the universe that strong and powerful element of love.

“Somewhere somebody must have some sense. Men must see that force begets force, hate begets hate, toughness begets toughness. And it is all a descending spiral, ultimately ending in destruction for all and everybody. Somebody must have sense enough and morality enough to cut off the chain of hate and the chain of evil in the universe. And you do that by love.

“There’s another reason why you should love your enemies, and that is because hate distorts the personality of the hater. We usually think of what hate does for the individual hated or the individuals hated or the groups hated. But it is even more tragic, it is even more ruinous and injurious to the individual who hates. You just begin hating somebody, and you will begin to do irrational things. You can’t see straight when you hate. You can’t walk straight when you hate. You can’t stand upright. Your vision is distorted. There is nothing more tragic than to see an individual whose heart is filled with hate. He comes to the point that he becomes a pathological case. For the person who hates, you can stand up and see a person and that person can be beautiful, and you will call them ugly. For the person who hates, the beautiful becomes ugly and the ugly becomes beautiful. For the person who hates, the good becomes bad and the bad becomes good. For the person who hates, the true becomes false and the false becomes true. That’s what hate does. You can’t see right. The symbol of objectivity is lost. Hate destroys the very structure of the personality of the hater.

“The way to be integrated with yourself is be sure that you meet every situation of life with an abounding love. Never hate, because it ends up in tragic, neurotic responses. Psychologists and psychiatrists are telling us today that the more we hate, the more we develop guilt feelings and we begin to subconsciously repress or consciously suppress certain emotions, and they all stack up in our subconscious selves and make for tragic, neurotic responses. And may this not be the neuroses of many individuals as they confront life that that is an element of hate there. And modern psychology is calling on us now to love. But long before modern psychology came into being, the world’s greatest psychologist who walked around the hills of Galilee told us to love. He looked at men and said: “Love your enemies; don’t hate anybody.” It’s not enough – to love your friends – because when you start hating anybody, it destroys the very center of your creative response to life and the universe; so love everybody. Hate at any point is a cancer that gnaws away at the very vital center of your life and your existence. It is like eroding acid that eats away the best and the objective center of your life. So Jesus says love, because hate destroys the hater as well as the hated.

“Now there is a final reason I think that Jesus says, “Love your enemies.” It is this: that love has within it a redemptive power. And there is a power there that eventually transforms individuals. That’s why Jesus says, “Love your enemies.” Because if you hate your enemies, you have no way to redeem and to transform your enemies. But if you love your enemies, you will discover that at the very root of love is the power of redemption. You just keep loving people and keep loving them, even though they’re mistreating you. Here’s the person who is a neighbor, and this person is doing something wrong to you and all of that. Just keep being friendly to that person. Keep loving them. Don’t do anything to embarrass them. Just keep loving them, and they can’t stand it too long. Oh, they react in many ways in the beginning. They react with bitterness because they’re mad because you love them like that. They react with guilt feelings, and sometimes they’ll hate you a little more at that transition period, but just keep loving them. And by the power of your love they will break down under the load. That’s love, you see. It is redemptive, and this is why Jesus says love. There’s something about love that builds up and is creative. There is something about hate that tears down and is destructive. So love your enemies.

“There is a power in love that our world has not discovered yet. Jesus discovered it centuries ago. Mahatma Gandhi of India discovered it a few years ago, but most men and most women never discover it. For they believe in hitting for hitting; they believe in an eye for an eye and a tooth for a tooth; they believe in hating for hating; but Jesus comes to us and says, “This isn’t the way.”

“As we look out across the years and across the generations, let us develop and move right here. We must discover the power of love, the power, the redemptive power of love. And when we discover that we will be able to make of this old world a new world. We will be able to make men better. Love is the only way. Jesus discovered that.

“And our civilization must discover that. Individuals must discover that as they deal with other individuals. There is a little tree planted on a little hill and on that tree hangs the most influential character that ever came in this world. But never feel that that tree is a meaningless drama that took place on the stages of history. Oh no, it is a telescope through which we look out into the long vista of eternity, and see the love of God breaking forth into time. It is an eternal reminder to a power-drunk generation that love is the only way. It is an eternal reminder to a generation depending on nuclear and atomic energy, a generation depending on physical violence, that love is the only creative, redemptive, transforming power in the universe.

“So this morning, as I look into your eyes, and into the eyes of all of my brothers in Alabama and all over America and over the world, I say to you, “I love you. I would rather die than hate you.” And I’m foolish enough to believe that through the power of this love somewhere, men of the most recalcitrant bent will be transformed. And then we will be in God’s kingdom.”

Keep Me Informed

Please enter your email address to be notified of new content, including market commentary and special updates.

Thank you for your interest in the Hussman Funds.

100% Spam-free. No list sharing. No solicitations. Opt-out anytime with one click.

By submitting this form, you consent to receive news and commentary, at no cost, from Hussman Strategic Advisors, News & Commentary, Cincinnati OH, 45246. https://www.hussmanfunds.com. You can revoke your consent to receive emails at any time by clicking the unsubscribe link at the bottom of every email. Emails are serviced by Constant Contact.

The foregoing comments represent the general investment analysis and economic views of the Advisor, and are provided solely for the purpose of information, instruction and discourse.

Prospectuses for the Hussman Strategic Growth Fund, the Hussman Strategic Total Return Fund, the Hussman Strategic International Fund, and the Hussman Strategic Dividend Value Fund, as well as Fund reports and other information, are available by clicking “The Funds” menu button from any page of this website.

Estimates of prospective return and risk for equities, bonds, and other financial markets are forward-looking statements based the analysis and reasonable beliefs of Hussman Strategic Advisors. They are not a guarantee of future performance, and are not indicative of the prospective returns of any of the Hussman Funds. Actual returns may differ substantially from the estimates provided. Estimates of prospective long-term returns for the S&P 500 reflect our standard valuation methodology, focusing on the relationship between current market prices and earnings, dividends and other fundamentals, adjusted for variability over the economic cycle.