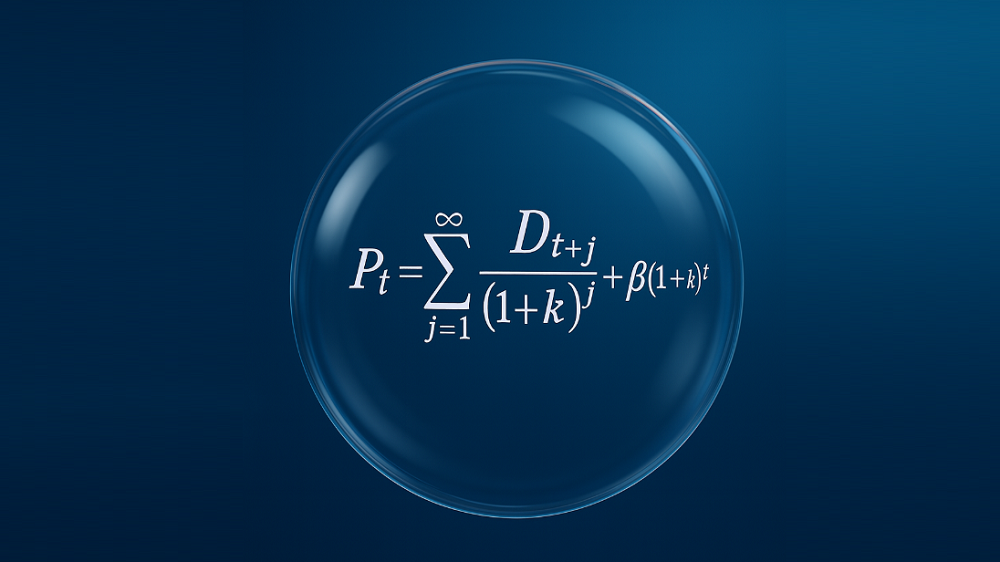

How the Bubble Manipulates Time

The defining feature of every bubble is the same: a growing inconsistency between the long-term returns that investors expect in their heads - based on extrapolation of the past, and the long-term returns that properly relate prices to likely future cash flows - based on valuations. Every bubble smuggles the same tragic past into the same tragic future by packaging it with new wrinkles that convince investors that this time is different. Ultimately, they still end the same way.