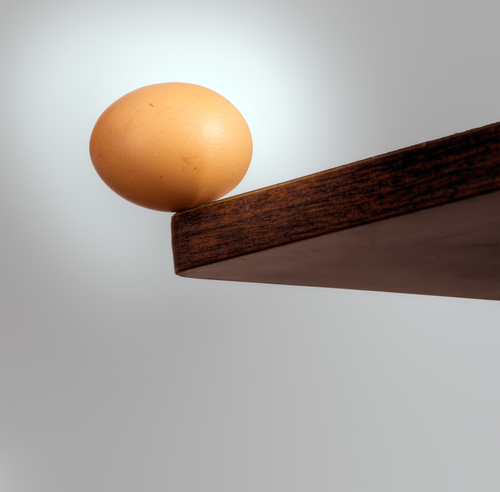

Mind the Trap Door

Even when extreme “overvalued, overbought, overbullish” warning signs are present, we now require explicit deterioration in market internals before adopting a negative market outlook. That, however, is far different than saying that extreme conditions can be ignored altogether. With market internals negative here, underlying market risks may be expressed abruptly, and with unexpected severity.