Top Dollar For Top Dollar

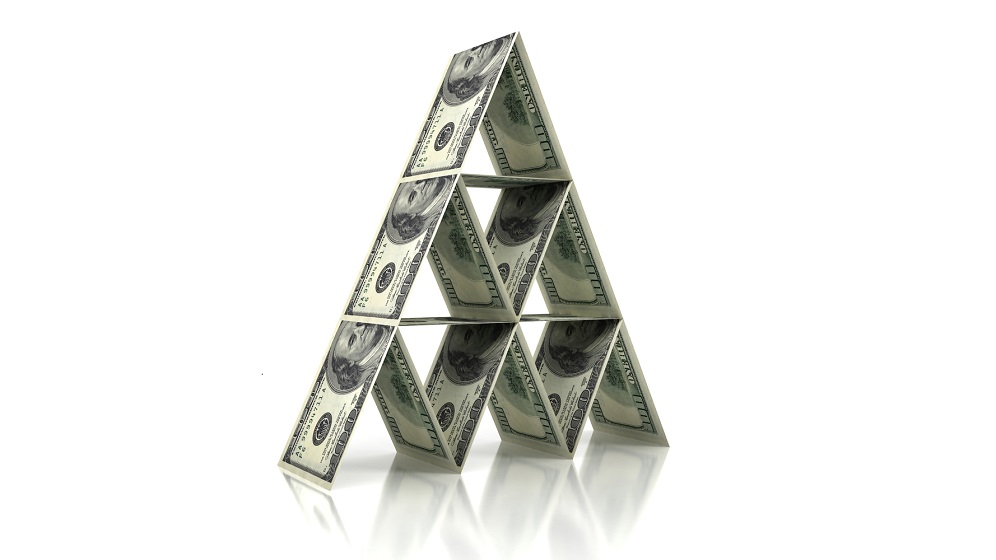

Record stock prices here are the product of a) record valuation multiples that have been inflated by a decade of zero interest rate policy, times b) record earnings that embed distorted profit margins inflated by trillions of dollars of temporary deficit spending. Investors are paying top dollar for top dollar.